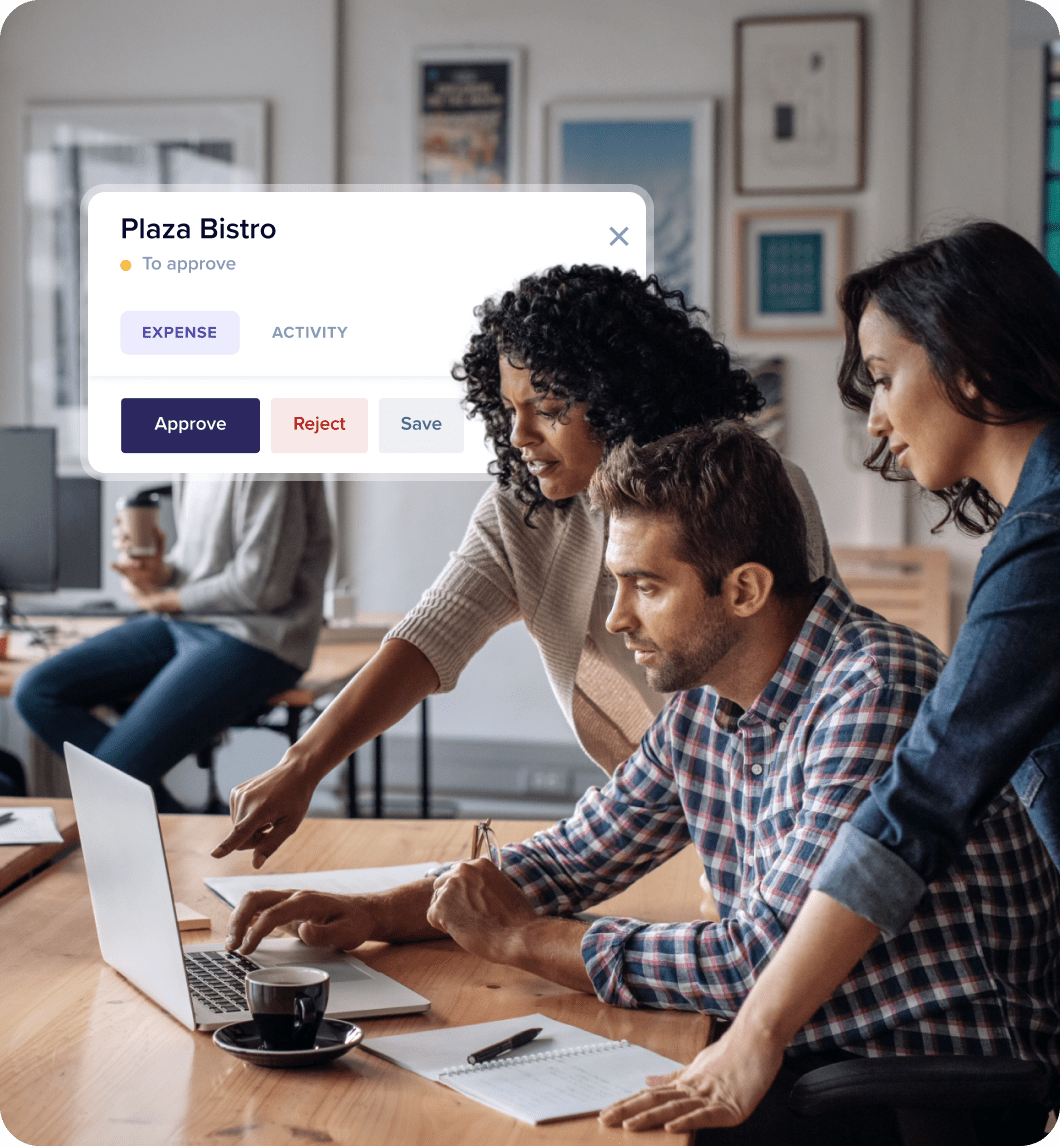

Smart expense management for efficient teams

Rydoo empowers finance teams to control employee spending, ensure local compliance, and increase efficiency by 3x.

Trusted by leaders and disrupters across 130+ countries

A smarter way to manage expenses

Why Rydoo?

Increase expensing efficiency

Submit and manage expenses effortlessly, in real-time and on the go.

Control employee spending

Get full visibility and control over employee spending, identify trends and anomalies, and respond promptly.

Ensure local compliance

Improve compliance and mitigate legal risks, wherever you do business.

Results you can measure

The number 1 expensing app in the market

GDPR compliant, ISO 27001 certified, SOC 2 Type 2 reported

Integrations

Connected with your favourite systems

Rydoo connects with over 35 Travel, HR, Finance, and ERP tools to enable full systems synchronisation

Customers

Don’t take our word for it, take theirs

Trusted by leaders and disrupters across 130+ countries