Do you have employees on a German payroll that work with per diems? Learn how Rydoo empowers your German Finance team with Rydoo’s German per diems engine, and the 3-month-rule report based on your needs.

Per diem expenses (daily allowances) are highly regulated by the German government. These types of expenses are tax-free to a certain limit in “value” but also in “time”. Once those limitations are exceeded, the full amount is not tax-free anymore.

In this article, we discuss both constraints, the difficulties they may pose to your financial team in Germany, and how our solution may help you overcome them while being compliant.

German Per diem rates: limitation in "Value"

Like many other countries, the German government has defined a maximum per diem “rate” that can be tax-free. If this rate is exceeded, the difference will have to be paid as part of their salary (taxed). This “limitation” will depend on:

- the location where the external work takes place

- departure/arrival timing

- the deductions

- among others.

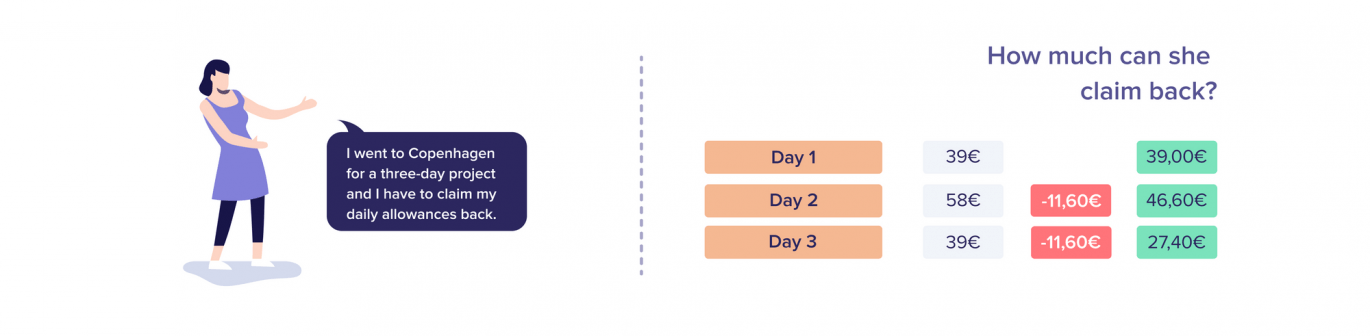

Let’s take a look at an example situation:

An engineer went to Copenhagen, Denmark for 3 days. The overnight stays – each with breakfasts – were booked and paid for in advance by the employer.

The calculation of expenses: The per diem rate for the arrival and departure days is 39 euros each (2021). The per diem rate for the second day, which was a full one, is 58 euros. Due to breakfast being provided as part of the overnight stay, the meal allowance has to be reduced by 11.60 euros each day (20% of the meal allowance in Copenhagen for a full calendar day: 58 euros)

Learn about our expense solutions

This is just one of the many scenarios that the variables defined by the German government can create. This can clearly make it difficult for your finance team to keep track. Some of the challenges they may encounter are:

- making sure that employees are submitting per diem expenses correctly (f.e. the right rates)

- making sure that managers and other controllers are able to identify which per diems are correct for approval

- knowing when the rates have been changed by the government, to inform employees and approvers

- calculating what the value of each per diem should be

- checking that deductions are correctly applied

That’s why we simplified this process with our per diems engine, so your finance team doesn’t have to worry about these challenges.

Learn more about our per diem management

Rydoo’s per diems engine

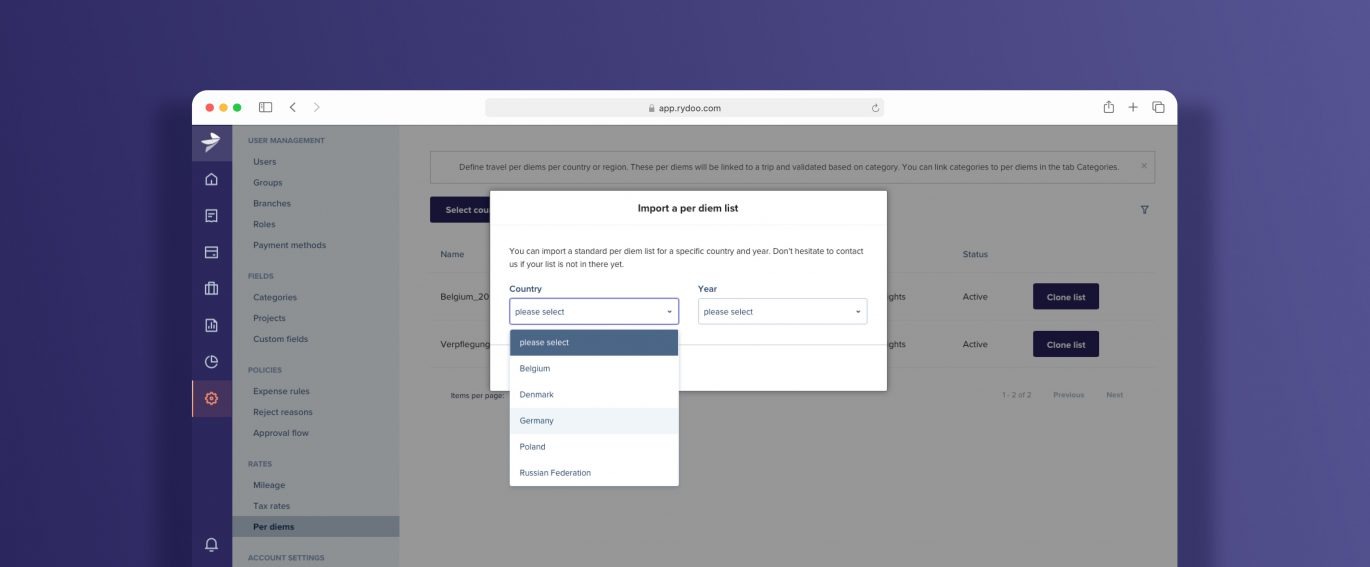

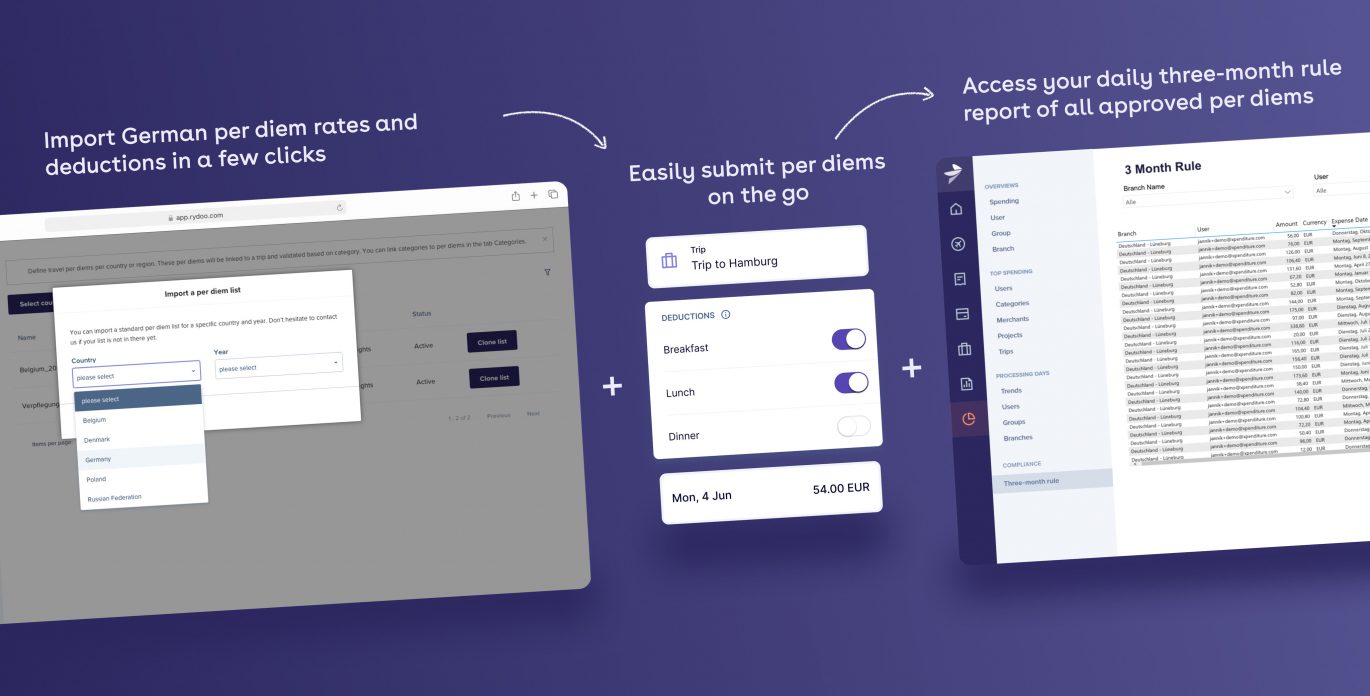

We built an engine that automatically calculates the per diem rate in compliance with German regulations. All your finance team has to do is import the “German per diems list” to your Rydoo account, assign it to all employees on a German payroll, hit save, and the engine will do the rest. What’s more, we keep the rates up-to-date, in compliance with any changes announced by the German government.

Compliance through automation

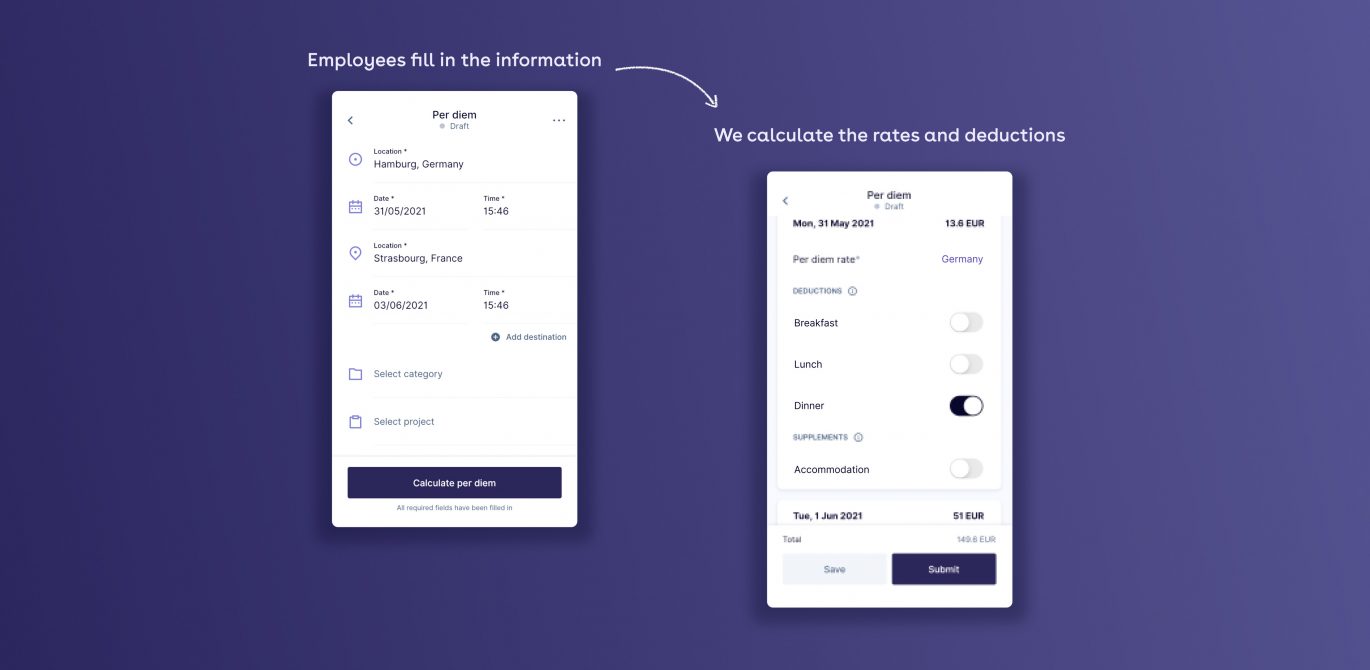

So, how does it work? When your employees create a per diem expense they will have to provide the destination and arrival/departure dates. Our engine takes this information and automatically calculates the exact daily allowance value and meal deductions for each per diem generated to be able to reimburse the employee without being taxed.

For example, if one of your employees goes to Strasbourg for 4 days, and your finance team already has the per diems engine running, this is how it would look like when your employee creates a per diem:

As you can see, after they provide the information, our engine calculates and shows the daily allowances – with the respective deductions, in case these need to be excluded.

The three-month rule: limitation in "Time"

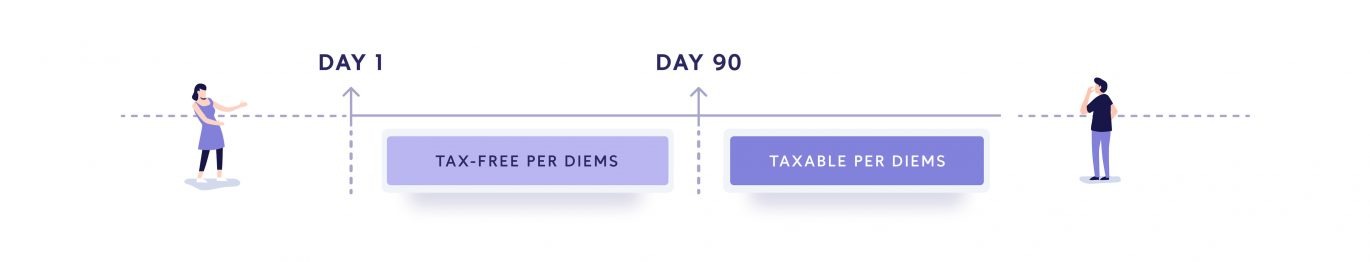

The three-month rule (Dreimontatsfrits) is an additional rule given by the German government to limit reimbursable per diems to a three-month period. This means that:

- The per diems created by a single employee for the same external location (project) will be tax-free if created within the 3-month window.

- All per diems created for the same project outside of the 3-month window (as of day 91) are taxed and paid as part of the employee’s payroll.

This rule has a set of “conditions” which define:

- When the rule starts, hence when the “3 months” window starts running.

- What can cause the rule to stop running

- What can cause the rule to start again (be interrupted)

So if you understand when the rule starts and ends, your finance teams know which per diems are tax-free versus taxable. But we know that it is not so simple. Your finance team deals with hundreds and hundreds of per diems, from different employees who work on different projects at the same time. Things can easily become overwhelming and get out of control. And let’s face it, this is where tasks become very time-consuming and mistakes happen (we’re only human).

This is why we have created a report that helps your German finance team skip many steps in this process: Rydoo’s three-month rule report.

Rydoo’s three-month-rule report

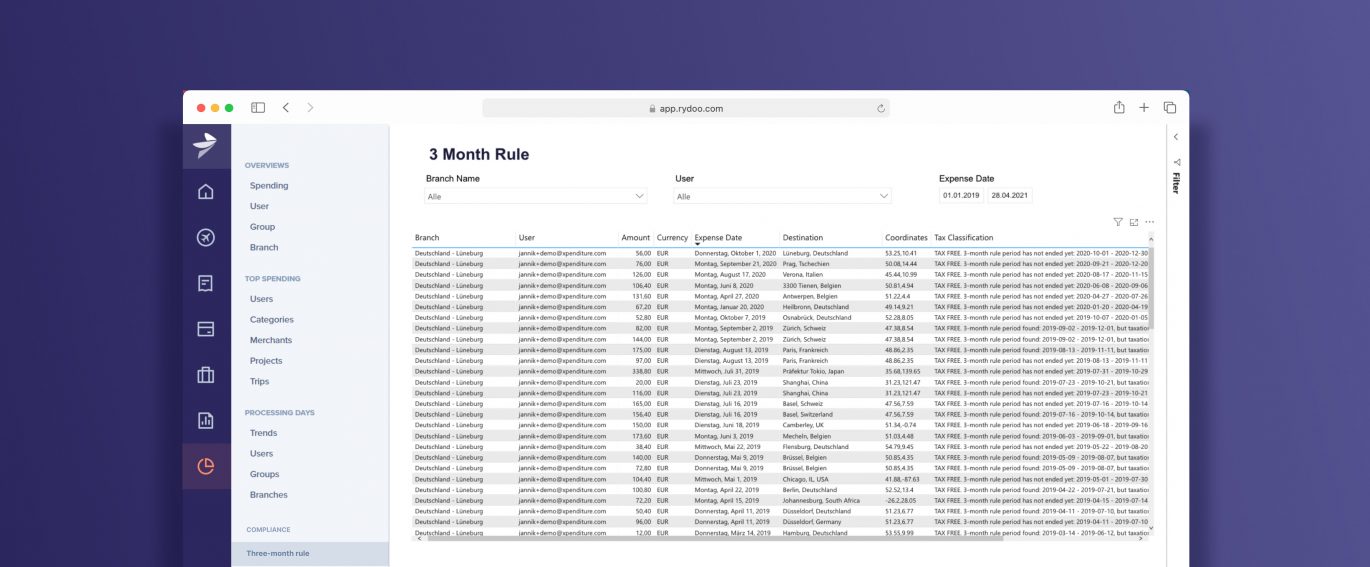

Our 3MR report lists all approved per diems created by any employee on the German payroll and pre-categorises them as tax-free or taxable based on the German 3MR legislation.

Smart insights

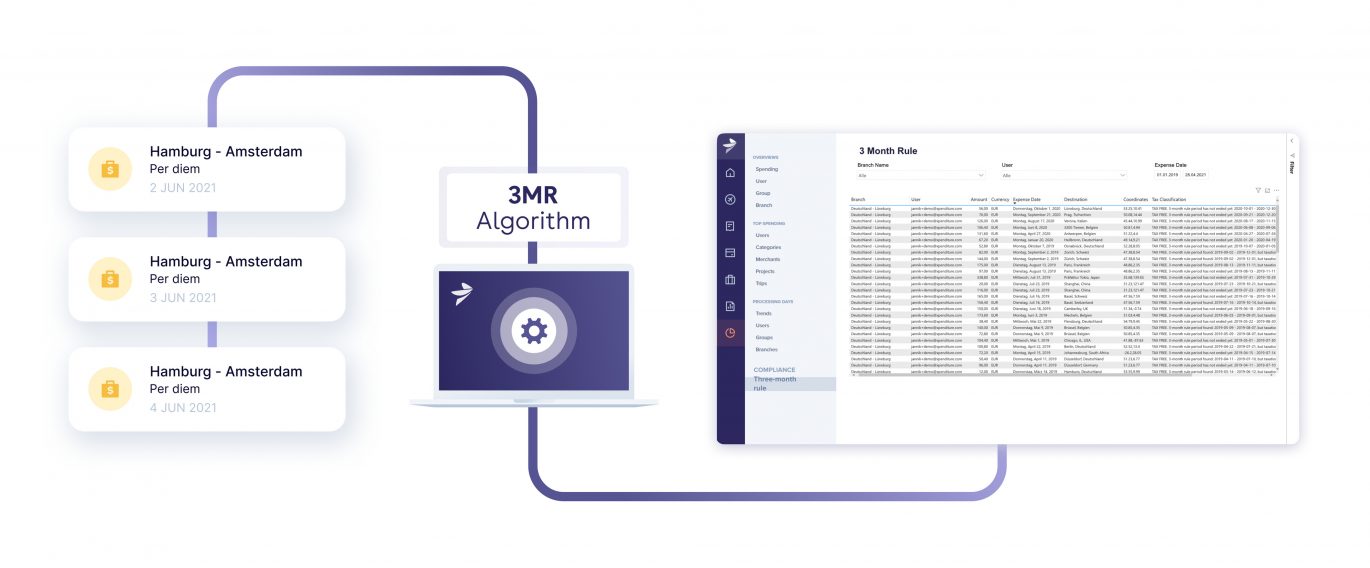

How does it work? We have built an algorithm based on the conditions given by the German government so that it knows when the 3-month rule starts, ends and is interrupted. It then automatically pre-categorizes approved German per diems as tax-free or taxable.

This list of approved per diems and its pre-categorization are shown as a report on Rydoo Insights (our analytics module), where your finance team can:

- filter by user or filter by German legal entity in case you have more than one

- define a time-frame (based on when the per diem started)

- export the report to double-check it and, if desired, upload it to the accounting system

Get a comprehensive view of how a digital expense solution alleviates a lot of the (non-)compliancy issues.

Our Three-month rule report in action

Give your finance teams a report powerful enough to help them save time when managing per diems:

- It runs under an algorithm compliant with the German regulations

- It automatically pre-classifies your company’s per diems as “tax-free” vs “taxable” per diems

- It can be exported for further analysis

- It is available 24/7 and daily updated

We help your finance team manage per diems in an efficient way while staying compliant

So, how does everything come together?

- Our per diems engine helps your finance teams set up all the rates in a couple of clicks.

- Your employees can create per diem expenses on the go and in seconds.

- Your German finance team has direct access to all approved per diem expenses already pre-categorized by reimbursable (tax-free) versus taxable (must be paid as part of the salary) – all ready for export.

This is how we help you make your existing flow smarter, giving your German finance team true control through automation.

If you would like to continue the discussion around German per diems, or other topics related to German compliance and how we help your team manage them, let’s have a talk.