There’s no need to sugarcoat it: submitting business expense claims can be a hassle. Something as simple as buying staples for the office can turn into a labyrinth for the employee, the approver, and the finance team. People forget to claim expenses on time, receipts get lost or damaged, and personal spending can get mixed up with business expenses.

Mistakes happen, but even minor errors can lead to non-reimbursement, financial discrepancies, or unintentional suspicion of fraud. The good news? Knowing exactly what to watch out for — and having the right tools in place — can help prevent these issues before they happen.

In this article, we will break down employees’ top expense report mistakes when submitting claims and how to avoid them. Employees often face challenges that complicate the expense process, such as losing or misplacing receipts and mixing personal and business expenses. Missing company policy limits, submitting duplicate expenses, and forgetting to record the business purpose are just a few issues that can lead to compliance concerns and financial discrepancies.

Identifying these challenges and implementing effective strategies can help optimise expense management and streamline reimbursement processes.

- Losing or misplacing receipts

- Submitting damaged receipts

- Mixing personal and business expenses

- Being unfamiliar with the company’s expense policy

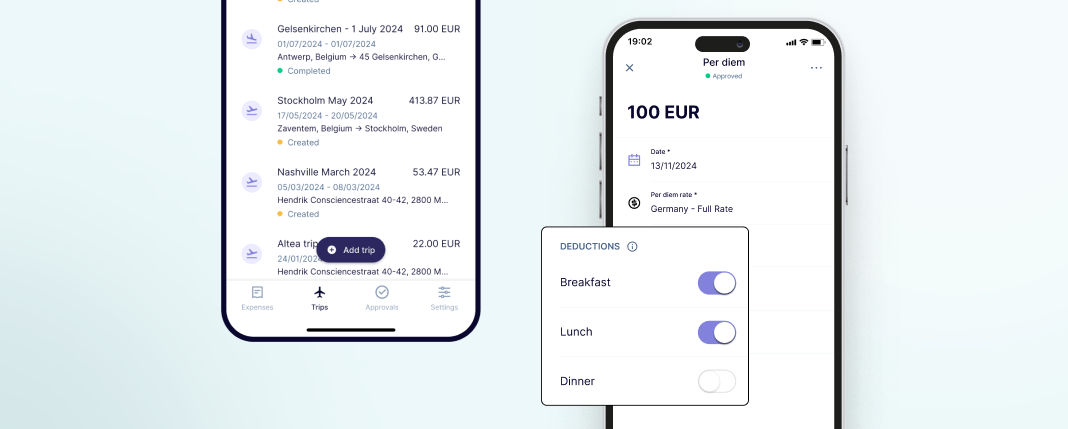

- Mixing up per diem and travel-related expenses

- Tracking mileage incorrectly

- Submitting duplicated expenses

- Not recording the business purpose of the expense

- Not claiming expenses on time

Losing or misplacing receipts

If you work in finance, this scenario is all too familiar: it’s the end of the month, time to verify expenses, and half of the receipts are missing.

Receipts and invoices are essential for reimbursement. Without them, the Finance team cannot verify the amount spent, putting the claim at risk of rejection. Additionally, missing receipts can raise compliance concerns and complicate audits.

The easiest way to prevent this is to use an expense management platform such as Rydoo. The platform allows employees to scan and digitally store their receipts. With Rydoo’s AI-powered OCR technology, employees can capture receipts in seconds, reducing the chance of losing physical copies.

However, keep in mind that certain countries may still mandate having a physical copy because local regulations prevent a completely paperless expense management system.

Submitting damaged receipts

It can be difficult to keep receipts in good condition until you need to submit them. They often crumple in pockets or get overlooked in wallets, making them unreadable before you realise it.

For finance teams, a crumpled or faded receipt is as good as having no receipt at all. If it can’t be read, the expense cannot be verified, which means it won’t be reimbursed, as finance needs to protect the organisation in case of an audit.

Instantly scanning and digitising receipts allows finance teams to maintain clear and legible expense records, even if the original copy becomes damaged. With the Rydoo mobile expense app, employees can scan their receipts as soon as they receive them, preventing any issues later.

Mixing personal and business expenses

It’s quite common to mix personal and business expenses. Imagine an employee taking a client out for drinks at a restaurant’s bar. Later, they continue the night with friends at the same place, leaving the original tab open. In the end, the receipt includes both business and personal charges, leading to a reporting nightmare.

Companies must ensure that all items on a receipt are work-related, as blending personal and business expenses can lead to inaccurate financial reports and complicate audits. For employees, this might lead to perceptions of carelessness or, worse, deceitfulness.

Using separate payment methods for personal and business transactions is one of the simplest ways to prevent this issue, and it can also help avoid out-of-pocket spending. When paying with a Rydoo Card, the software automatically generates an expense claim; all the user needs to do is attach the receipt. Additionally, Rydoo Smart Audit will automatically flag any out-of-policy claims before submission, meaning that users will be alerted that the receipt might include non-reimbursable items so they can correct the expense.

Being unfamiliar with the company’s expense policy

Imagine a company event where the team buys gifts for the speakers. The next day, they submit the expense report, only to discover it exceeds the limit set by company policy.

Employees unfamiliar with the company’s expense policy often make mistakes. Even if a misunderstanding is clarified, lingering uncertainties can affect future submissions. Companies should ensure that policies are easily accessible and clearly communicated to all employees. However, a foolproof way to guarantee that nothing slips through the cracks is to implement a system that helps enforce company policy.

Rydoo allows you to set up policy warnings in your account, alerting users to any potentially non-compliant expenses prior to submission. The system will also bring these issues to the attention of the approver and the finance team to ensure appropriate handling.

Companies should ensure that policies are easily accessible and clearly communicated to all employees.

Tracking mileage incorrectly

Mileage claims are essential for employees on the move, but they can also be one of the most overlooked or inaccurately recorded expenses. Unlike other expenses, which are often linked to meals or accommodation, mileage depends on continuous and accurate tracking. The challenge arises when employees, often focused on preparing for the client meeting or event they’re attending, forget to record the start and end points of their journey.

This not only affects reimbursement but also impacts the company’s financial records, leading to potential discrepancies during audits.

Using digital systems can help overcome this challenge and avoid mistakes while submitting expense reports. Rydoo’s mileage tracking system, for instance, allows employees to mark the starting and ending points of their trip using Google Maps, and the software automatically calculates the mileage reimbursement rates for the trip, according to local laws and regulations. This helps the employees get fair rates for their reimbursements and keeps the organisation compliant.

Submitting duplicated expenses

When juggling multiple expenses, losing track of what has already been submitted is easy. Receipts get mixed up in folders, multiple software subscription invoices flood inboxes, and mistakes happen.

This results in duplicate claims, whether by accident or, in some cases, fraud. These discrepancies in the organisation’s financial records can be seen as fraudulent behaviour, exposing both the company and the employees to potential fines.

Rydoo’s Smart Audit can help avoid duplicate expenses by automatically flagging them before submission. The system uses advanced correlational analyses using identifiers such as amount, currency, date, and time to ensure reporting integrity. Each duplicated expense is flagged for review and can be rejected with just a few clicks.

These discrepancies in the organisation’s financial records can be seen as fraudulent behaviour, exposing both the company and the employees to potential fines.

Not recording the business purpose of the expense

Submitting expenses involves not only the amount but also the reasons for incurring them. Although it seems straightforward, many employees overlook this step when submitting claims.

Documenting the purpose of the expense is crucial for finance teams for several reasons — from auditing to financial planning. Omitting this detail can lead to approval delays, audit difficulties, and compliance risks.

Including this information is a best practice to ensure the company’s resources are used responsibly, and it can be easily done with expense management software. With Rydoo’s software, it’s possible to require comments for all claims, meaning employees cannot submit their expenses without adding them.

Not claiming expenses on time

Procrastination is a costly habit, especially when it comes to submitting expenses. The longer it takes to submit a claim, the higher the risks.

Receipts get lost, or details around the expense are forgotten, disrupting budgeting and forecasting for finance teams and leading to employees forfeiting the reimbursement altogether.

Submitting expenses as soon as they happen is the best way to avoid this issue. By providing a system such as Rydoo’s, which allows for that to happen in seconds and on the go, companies prevent last-minute rushes and improve financial planning.

Knowing the most common mistakes when submitting expenses is the first step to leaving them in the past. Adopting smarter solutions and taking advantage of modern tools can make it easier for the whole organisation, from end-users to the finance team.

Smart expense management solutions like Rydoo’s use advanced capabilities to help minimise these issues. From detecting duplicate claims to enforcing company policies and automating approvals, the software ensures that expense management is fast, compliant and stress-free. If you want to know more, book a demo with our team today.