Whitepapers

Expense Compliance in the Age of AI: Challenges and Opportunities

Foreword

Expense compliance has long demanded significant time and attention from finance teams. Manual reviews are slow, policy enforcement is uneven, and errors or violations often go undetected, resulting in excess costs, delayed reimbursements, and increased exposure as volumes and complexity rise.

This report maps the current compliance landscape, the operational realities facing finance functions, and the practical opportunities created by recent advances in AI.

We examine the root causes of non-compliance, why manual processes fail at scale, and how AI can augment (not replace) skilled reviewers, enabling finance teams to achieve smarter, faster, and more accurate expense compliance.

Sebastien Marchon, CEO

Methodology statement

Unless otherwise stated, the findings in this report are drawn from Rydoo’s Smart Audit dataset, covering more than 10 million processed expenses from 2024 to 2025. The analysis includes only anonymised, consent-based data from participating customers. Results are presented as aggregate, weighted averages, offering an indicative view that may differ by organisation type, policy setup, and regional context.

Disclaimer

This report is a perspective document. All findings and insights represent the authors’ interpretation of Rydoo data and broader industry developments. They do not constitute financial or compliance advice and should be considered in the context of local regulations and internal company policies.

Executive summary

AI is changing expense control from periodic checks to continuous assurance. Rydoo Smart Audit data show that relatively small pockets of non-compliance, paired with undifferentiated manual reviews, create avoidable costs and risks. Finance teams can now combine real-time monitoring with human-in-the-loop (HITL) oversight to raise quality, reduce effort, and optimise expense control.

Key findings

Even relatively small non-compliance has significant impact

Around 86% of expenses are compliant; the remaining 14% split into 9% non-intentional (errors, misclassification, missing data) and 5% intentional (duplicates, falsified/manipulated claims). Undetected issues can drive 5–14% excess reimbursements and weaken VAT recovery.

Manual reviews don’t scale

A mid-sized company (∼650 employees; 46k claims/year) can spend ∼1,950 hours annually on checks, mostly low-value while still missing patterns and repeat issues.

AI improves both accuracy and productivity

AI can analyse 100% of claims in real time, flagging anomalies with ∼97% accuracy. About 70% of low-risk, recurring claims can be processed automatically, so reviewers only focus on exceptions.

Adoption is cautious and layered

Early AI audit adopters start with prevention and augmentation (submission feedback, translation, keyword and duplicate detection) and keep HITL for edge cases. Automation expands as trust grows.

Platform choice matters

Embedded AI inside the expense platform offers faster time-to-value and simpler governance. Integrated AI (add-on audit) is viable when upgrading the platform is not possible, but typically adds commercial, connectivity, and data complexity.

Looking ahead

No-touch expenses become the default for low-risk claims

AI supports expenses submission further preventing errors and rework; finance focuses on ambiguous or high-risk cases.

Agentic AI drives adaptive expense governance

Audit systems will be able to work more autonomously, learn from patterns, adjust thresholds, and recommend policy changes in real time. Finance retains oversight, approves changes, and benefits from a full audit trail.

Real-time dynamic guidance replaces static training

Rules, warnings, and budget context appear during entry, not after the fact. Error rates fall, rejections decline, and employees gain clarity without additional classroom training.

The insights behind expense compliance

Most expenses are compliant, but small failures have an outsized impact

Rydoo Smart Audit data reveals that finance teams are leaving significant efficiency gains unclaimed, particularly in the handling of recurring, low-risk claims.

Automation potential is significant Almost 70% of expenses are low-risk and can be processed automatically. This creates a material opportunity to free hundreds of hours per year for finance teams and approvers while improving review quality and consistency.

![]() Not all non-compliance is equal Compliance failures do not necessarily mean fraud. Errors, misinterpretations, and systemic gaps account for the majority of issues detected in expense processes.

Not all non-compliance is equal Compliance failures do not necessarily mean fraud. Errors, misinterpretations, and systemic gaps account for the majority of issues detected in expense processes.

The impact on profitability is real Even small pockets of undetected non-compliance can erode margins. Excess reimbursements of 5–14% of total spend are common, directly affecting profitability and VAT recovery.

Exhibit: expense compliance split

Source: Rydoo Smart Audit dataset (2024–2025).

Figures represent averages. Variance by scale, sector, and region might apply.

- Submitted expenses

Includes all employee-submitted claims under review, such as out-of-pocket reimbursements and company card transactions. Compliant expenses (86%)

Claims that adhere to company policy. These fall into two distinct categories:- Automatable expenses (68%)

Low-risk, recurring, or low-value claims that can be processed by AI from end to end, with no need for human intervention. Common examples include subscriptions, commute allowances, and small routine purchases. - Complex compliant expenses (18%)

Legitimate claims that follow policy but require additional context or expert judgement. These are best reviewed through human-in-the-loop (HITL) processes and often include high-value items, policy exceptions, or sensitive spend categories.

- Automatable expenses (68%)

Non-compliant expenses (14%)

Claims that fall outside company policy. These are further classified into:- Non-intentional violations (9%)

Resulting from errors, misclassifications, or misunderstandings of the policy. Often linked to vague rules, ambiguous categories, or manual mistakes. - Intentional violations (5%)

Deliberate attempts to bypass policy, including duplicated, falsified, or manipulated claims. These cases represent the highest compliance risk and typically require investigative follow-up.

- Non-intentional violations (9%)

Exhibit: non-compliance at a glance

| Type | Share of all expenses | Typical causes | Common types | Mitigation approach |

|---|---|---|---|---|

| Non-intentional | 9% | Policy ambiguity, manual error | Excessive travel spend, prohibited items | UX, education real-time alerts, AI monitoring |

| Intentional | 5% | Financial pressure, opportunity, and rationalisation | Fabricated expenses, manipulated claims, duplicate claims | clear policy guidelines AI monitoring |

Most common types of non-compliant expense

Exhibit: most common types of non-compliant expenses (% of flagged expenses)

Source: Rydoo Smart Audit dataset (2024–2025).

Findings categorised and aggregated for simplicity. All figures are rounded.

“It’s common for employees to submit non-compliant expenses by mistake, but if all claims need to be manually reviewed, companies face serious risks of compliance breaches and even financial losses.”

Elisa Vanderstraeten, AI & Automation Product Manager

Exhibit: financial impact of non-compliance [Illustrative]

Impact example (mid-sized company):

- Employees actively submitting expenses: 650

- Avg expenses per employee/year: 60

- Avg claim value: €75

- Estimated yearly claims: 39,000

- Estimated annual reimbursements: ≈ €2,925,000

Financial impact:

- Non-intentional (39,000 × €75 × 9%): ≈€263,250

- Intentional (39,000 × €75 × 5%): ≈€146,250

- Total exposure: ≈€409,500/year (≈14% of employee reimbursements)

Impact of technology on expense compliance

Technology has lowered the barriers to both compliance and non-compliance

Digital tools have transformed expense management. They enable faster submissions, stronger reviews, and better tracking. However, technology also facilitates non-compliance and brings risks, including:

Increased spend and operating costs

Fake, inflated, or duplicate expenses are reimbursed, inflating budgets and reducing profitability.

Regulatory exposure

Missed violations raise the risk of VAT rejections, audit deficiencies, and penalties.

Compromised decision-making

Inaccurate expense data distorts reporting, forecasts, and strategic planning.

∼30% of expense fraud will be AI-generated in the coming years

Source: The New York Times

How technology enables non-compliance

Technology enables fraud in three main ways:

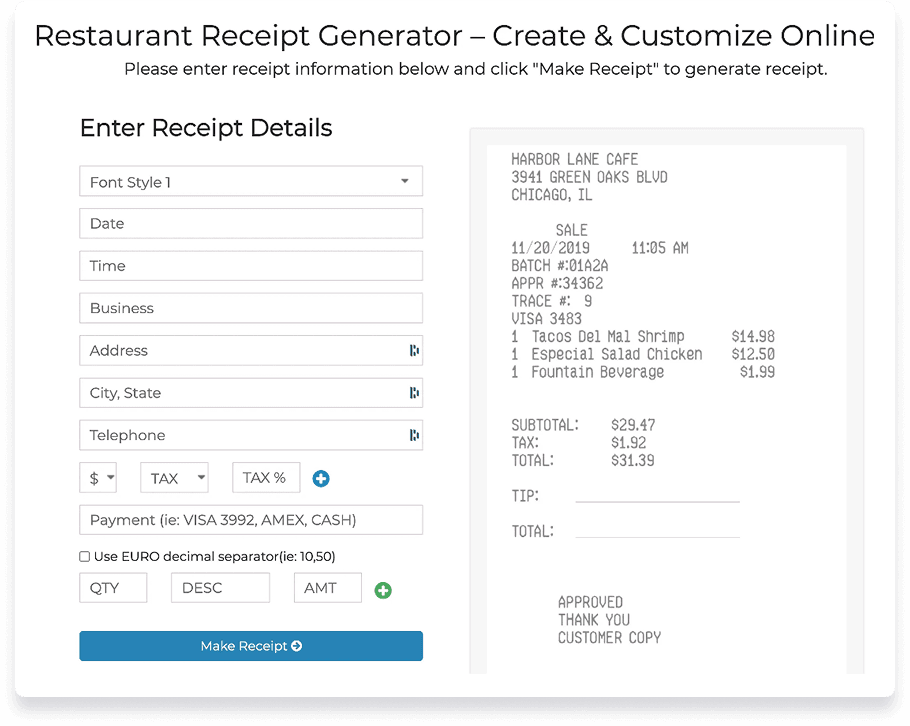

Receipts from templates

Free or inexpensive apps and websites (e.g. Receipt Maker, Invoice Simple) allow employees to create and submit fake receipts, often indistinguishable from legitimate ones.

Example: a free receipt generation online tool

AI-generated receipts

Platforms such as ChatGPT, Gemini, and Adobe AI can generate highly realistic receipts with matching fonts, logos, and even simulated wear and tear, making them difficult for manual auditors to spot.

Example: a fake receipt created with ChatGPT; side-by-side comparison.

Manipulated claims

Image editors (e.g., Photoshop AI) enable quick alterations to dates, amounts, or categories; screenshots can bypass simple validations.

Example: side-by-side comparison of a real and fake receipt

Insight: even with safeguards in place to prevent misuse, AI platforms like ChatGPT can often be bypassed, allowing for higher-quality fakes that are harder to detect manually.

The shortcomings of manual expense reviews

Manual expense reviews are insufficient and inefficient

Smart Audit data shows that for most companies, manual expense reviews are no longer sufficient to keep up with the growing volume and complexity of business expenses. At the same time, they divert skilled finance professionals from high-value work.

Accuracy risk

Manual checks often miss violations, inflating reimbursements and increasing compliance exposure.

Time burden

Teams can spend +2,000 hours per year on reviews, with effort concentrated on low-value tasks.

Cost of administration

Time spent on rework and admin limits the function’s contribution to the business

Exhibit: companies spend ≈1 FTE per year on expense review tasks [estimated and illustrative]

- Employees submitting expenses: 650

- Avg claims per employee/year: 60

- Manual processing time per claim: 3 minutes

- Total yearly claims: 39,000

- Manual review effort: ≈1,950 hours/year (0.95 FTEs)

Assumes a 40-hour week over 52 weeks. Processing time includes manual expense approval, controlling, and reporting.

Exhibit: manual controls affect every stakeholder

Employees

Unclear rules, repetitive admin, and slow reimbursements increase frustration and can drive non-compliance.

Managers/approvers

Review workload pulls them into an administrative middle tier, delaying resolution and distracting from leadership priorities.

Finance teams

Forced trade-off between quality and productivity leads to inconsistent control, delayed insights, and weakened trust in financial data.

Insight: processing an expense may take ∼3 minutes, yet claims often sit in the queue for +20 days before reimbursement, eroding employee experience and control.

Exhibit: manual expense processing is error-prone and inefficient [illustrative]

“Ensuring that all employees follow internal policies can also be a challenge, especially for those who still rely on traditional methods of manual expense management.”

Elisa Vanderstraeten, AI & Automation Product Manager

Enhancing compliance monitoring with AI

AI equips finance teams with flexible capabilities to scale compliance while reducing manual workload

Advanced AI audit solutions can close control gaps by enabling finance teams to automatically review every claim in real time and apply policy consistently, while maintaining human oversight where it adds value.

Policy enforcement

AI can embed and enforce virtually any expense rule, ensuring every claim is reviewed within the context of the company’s policy.

Speed and scale

AI can autonomously process around 70% of claims, reducing approval bottlenecks and cutting overall processing times by up to 30%.

Accuracy and control

By applying rules instantly and consistently with 97% accuracy, AI reduces oversight gaps, manual errors, and fraud.

AI helps finance teams automate routine tasks and amplify human skillset

AI can automate transactional tasks, while also extending what finance teams and approvers can see, catch, and act on. This brings higher precision, coverage and context to expense monitoring.

Exhibit: AI audit capability classification [non-exhaustive]

Augment

Support reviewers with deeper insights and clearer context.

Sample capabilities

- Smart scanning Identifies and pre-fills key receipt information for more accurate expense submission;

- Receipt translation Translates foreign-language receipts, enabling global oversight and faster reviews;

- Instant submission feedback Warns users in real time, reducing the need for back-and-forth follow-ups;

- Key detail spot Brings forward essential receipt info (e.g. merchant, VAT, total), so approvers don’t miss key points;

- Real-time analytics Surfaces policy trends, user behaviours, and team-level risks — insights that are hard to spot manually.

Automate

Reduce repetitive, manual tasks so teams can focus on exceptions.

Sample capabilities

- Duplicate detection Automatically flags matching claims across date, amount, currency, and merchant;

- Keyword detection Scans descriptions for policy violations (e.g. alcohol, tips) — no need to read every receipt;

- Fake receipt detection Flags suspicious file types, structures, or metadata before a human ever sees them;

- Attendee verification Highlights inconsistencies in names, roles, or duplicate attendees, improving accountability;

- HITL escalation Automatically routes ambiguous claims to a human reviewer with full context and justification.

Insight: as Agentic AI evolves, expense systems will shift from reactive monitoring to proactive management. Intelligent agents will anticipate risks, adapt controls dynamically, and automate low-risk workflows, delivering higher accuracy and efficiency.

Exhibit: AI replaces undifferentiated manual reviews with fast, focused exception handling [illustrative]

Insight: almost 70% of expense claims can be auto-reviewed and approved instantly, while the remaining subset requires human input. This shift allows for faster processing, fewer errors, and sharper focus on the exceptions that matter most.

Exhibit: AI audit workflows simplify expense processing across the organisation

| AI-enabled benefit | |

|---|---|

| Real-time guidance on policy. Fewer errors. Faster reimbursements. | |

| Review only what matters. Fewer approvals. Clear justification for exceptions. | |

| Scale control, reduce effort, and shift focus to true risk and strategy. |

“As regulations evolve and expectations rise, technology, and especially AI, will play an essential role in helping teams detect risks early, monitor behaviour in real time, and focus their efforts where human judgment matters most.”

Daniela Beck, CFO

Implementing AI for expense auditing

A successful AI adoption blends technology, strategy and change management

For finance operations, the question is no longer whether to adopt AI, but how to achieve impact with minimal disruption. Effective implementations blend technology, operating model, and change management. While configuration can be straightforward, outcomes also depend on workflow fit, ownership, and policy design.

“It’s really important to learn as a team. AI is changing so fast, you cannot learn alone, you have to learn as a group.”

Nicolas Boucher, Founder of the AI Finance Club

Adoption pathways: embedded vs integrated

Embedded audit delivers speed and simplicity. Integrated solutions suit teams keeping legacy platforms.

Finance teams typically face two pathways when adopting AI for expense monitoring:

Embedded / consolidated AI

AI audit is built into the expense platform (e.g., Rydoo Smart Audit). Best for teams ready to modernise their stack.

- Real-time checks during submission;

- Fewer vendors and touchpoints;

- Centralised data and control;

- Faster implementation and time-to-value;

- Native configuration flexibility;

- Embedded compliance analytics.

Integrated AI

A separate AI audit layer on top of an existing platform. Viable when upgrading the expense system is not an option.

- Also offer robust AI auditing capabilities;

- Are competitive options when the expense platform does not offer embedded AI audits or when upgrading expense platform is not an option;

- Require more complex implementation due to contracting and technical integration.

Learnings from the field

Exhibit: common implementation pitfalls and best practices

| Best practice | |

|---|---|

| Assumes AI will fix all compliance issues immediately. | Define success metrics and baselines. Start with a pilot, track outcomes, and adjust thresholds and rules regularly. |

| Projects move ahead without clear roles or a plan to prepare impacted employees. Communication and upskilling are treated as an afterthought. | Map project leads and key stakeholders. Explain the “augment, not replace” message. Provide targeted training and on-the-job guidance throughout the transformation. |

| Policies are hard to interpret and not ready for automation. | Simplify and codify rules with examples and local variations; standardise categories/merchants; version-control updates; review edge cases quarterly to keep rules current and machine-readable. |

How finance pioneers use AI for expense compliance

AI adoption is a staged journey: prevent first, augment next, automate when ready.

AI adoption in finance is a journey, not a jump. Most teams start small, experimenting cautiously and expanding their AI footprint once trust has been established; the result is fewer errors, faster reviews, and increased confidence in compliance.

Exhibit: sample AI compliance adoption [illustrative]

Preventive AI is often the first step

Finance teams are most comfortable embedding AI at the point of submission with features like instant warnings, smart field pre-filling, and itemisation. These preventive tools reduce the volume of incorrect or non-compliant submissions before they ever reach approvers or finance teams.

Finance leaders prioritise augmentation over automation

When it comes to auditing, early adopters often prioritise AI features that support rather than replace reviewers. Capabilities like receipt translation and real-time submission warnings are commonly adopted first. These tools don’t take control away from humans; they help reviewers and submitters make better decisions.

HITL remains the dominant model

Rydoo data suggests that the overwhelming majority of AI expense audit adopters still operate under a human-in-the-loop (HITL) model. In this setup, the AI analyses 100% of claims in real time, but only escalates potentially risky or ambiguous ones for human review.

This model provides a high level of control, transparency, and trust. Teams feel confident knowing that the system is reviewing everything, but that humans still make the final call when it matters.

“Our primary goal with AI audit was to raise the quality of our expense reviews. The successful AI implementation laid the foundation for further automation down the line.”

Dino Merico, Head of Group Finance & Controlling

Expected evolution of expense monitoring

AI will evolve from detection to prevention and education

AI in expense compliance is moving from oversight to foresight. The next phase of adoption is defined by proactive control, dynamic policy evolution, and embedded intelligence across the submission process. The next frontier for forward-looking finance teams is to have AI prevent non-compliance rather than only detect it.

No-touch expenses will become the default for low-risk claims

With policy rules embedded at the point of submission, automated processing will continue to scale, reducing the need for manual review, routing, or delays. Human intervention will focus solely on ambiguous or high-risk cases, freeing capacity for more strategic work.

Outcome: faster reimbursement, consistent control, and significantly reduced manual load for finance and approvers.

Agentic AI will drive dynamic, adaptive expense governance

Today’s AI enforces predefined rules. Tomorrow’s systems will learn, adjust, and optimise policy frameworks in real time. These models will monitor trends, flag emerging risk patterns, and propose control refinements based on behavioural insights.

Outcome: compliance frameworks that evolve alongside business priorities and operational risk profiles.

Exhibit: expense automation evolution [illustrative]

Insight: inflection points: mobile submission (volume and speed increase), augmentative AI (full population review, triage), Agentic AI (policy recommendations and orchestration).

Real-time guidance will replace static training

Instead of relying on policy PDFs or training slides, employees will receive real-time nudges during submission, surfacing rules, warnings, and budget context exactly when it’s needed.

Examples:

- Smart alerts when an expense is likely to breach policy;

- Budget-aware nudges during claim creation;

- Preferred vendor suggestions based on compliance history.

Outcome: lower error rates, fewer back-and-forth, and improved user confidence at the point of spend.

“We’re moving from AI that follows rules to AI that helps redesign them. The next generation of expense audit systems won’t just flag exceptions but learn from patterns, suggest smarter controls, and guide users in real time. That’s how finance evolves from oversight to intelligent governance.”

Sebastiaan Vanhecke, Chief Product Officer

Implications for finance leaders

AI shifts expense control from periodic checks to continuous assurance.

Capture quick wins now while laying foundations for agentic capabilities later.

1 Evaluate audit needs first

Success depends on solving the right problems, rather than deploying features. Diagnose where leakage or effort concentrates (e.g., duplicates, missing receipts, slow approvals). Define success metrics and baselines.

2 Identify potential audit providers

Fit matters more than features in isolation. Evaluate vendors by: accuracy, flexibility, time-to-vale, connectivity, analytics depth, security posture, and product roadmap.

3 Redesign the operating model: HITL by default

AI should handle volume; humans should handle ambiguity and risk. Work with your AI audit vendor to set triage thresholds and routing rules (auto-approve, auto-reject, escalate). Capture reviewer rationale and outcomes.

4 Start with augmentation, scale to automation

The cheapest error is the one prevented at submission. Enable instant policy feedback, keyword alerts, translation, and duplicate detection. Expand auto-approval only after thresholds and HITL flow are stable.

5 Treat policy as code

Vague rules drive noise and inaccuracy. Before implementing an AI audit system, prepare the ground and work with your audit vendor to codify policies into machine-readable rules, including examples and local variations. Test these rules on historic claims and maintain version control.