I made my career in the accounting area, and for many years I had to deal with the problematic paper expense reports, summary sheets with dozens of documents attached. To begin the validation process, I had to remove many staples to reach the documents and then deal with lots of unreadable invoices/receipts (e.g, crumpled papers, or documents that after some time had already lost their ink).

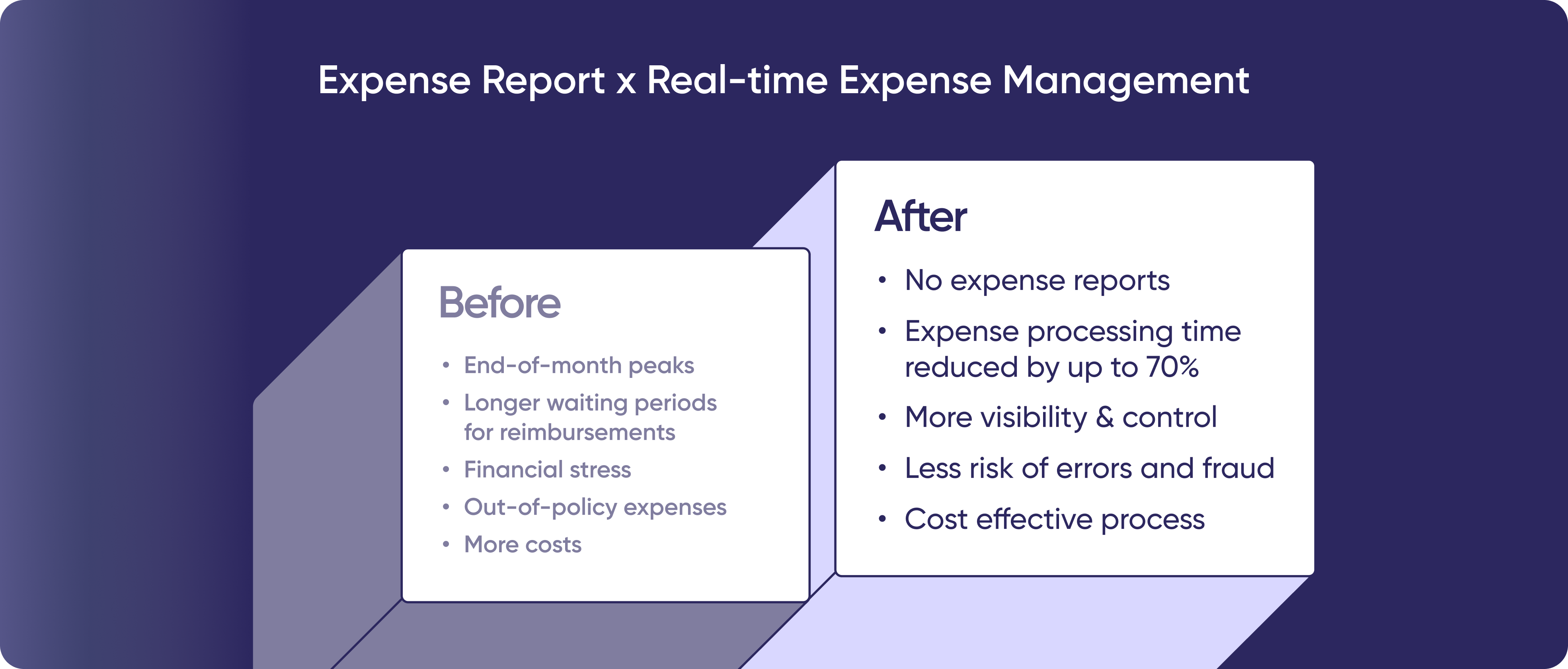

In a time where almost everything is instantaneous and can be done anytime, anywhere and in any device, having to wait until the end of the month, the end of a project or even the end of a trip to submit an expense and have it reimbursed, started to be outdated. Doing expense management manually was not keeping up with the technological evolution of other financial processes. For that reason, we decide to start looking for a solution to help us solve problems such as end-of-month peaks and endless loops of expense reports that were very time consuming for the finance team.

When we decided to take on this project, we started by designing the process “as is” — or we can already say “as was” — then we measured the time each process took, identified stakeholders, systems, and problems. This journey was key for us to be able to evaluate the potential of the solutions currently available and to identify which was the one that would better fit our needs. We decided to choose Rydoo and we started the implementation process.

Doing expense management manually was not keeping up with the technological evolution of other financial processes.

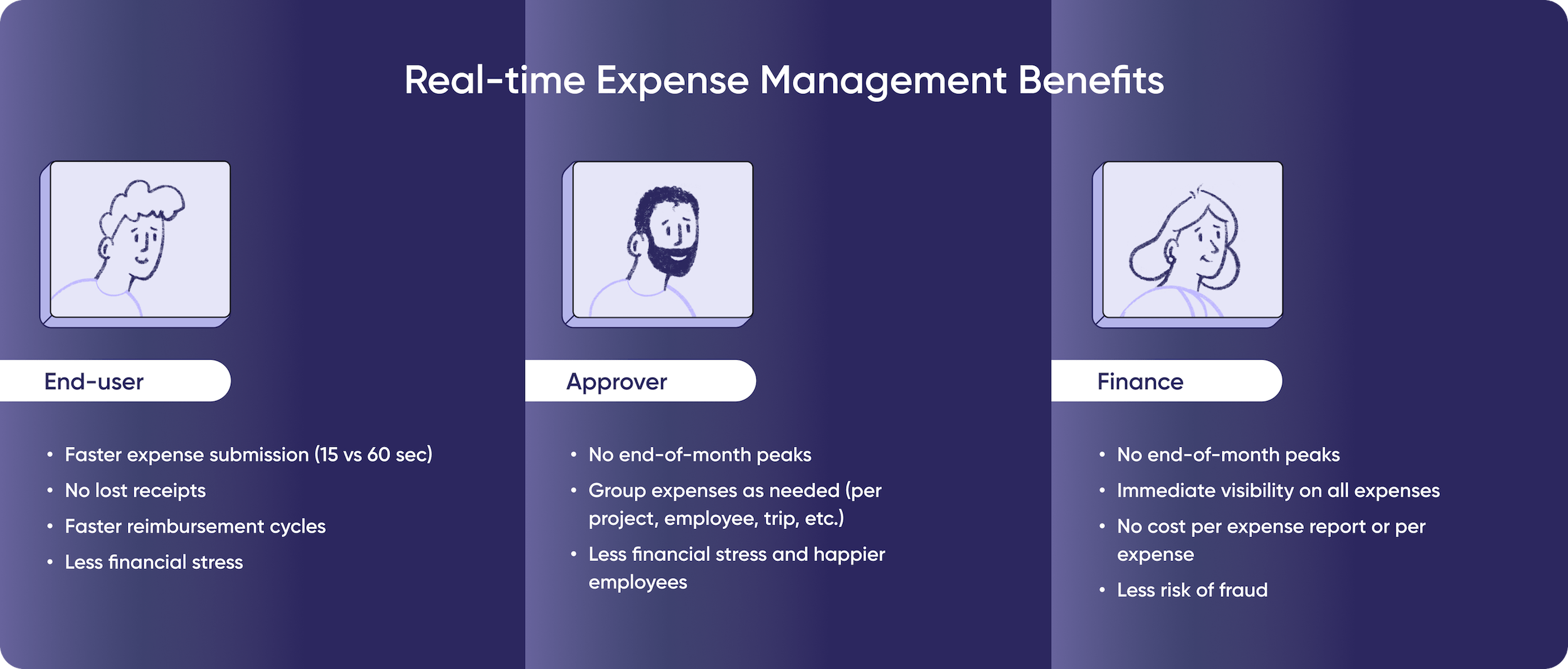

It didn’t take long before I started noticing some improvements, not only from a financial process point of view, but also by the positive impact on the team spirit. Employees were happier with Rydoo. Fewer receipts were lost, the approval processes became faster for the approver and the finance team gained more visibility and control. This new process with more efficient and modern tools allowed everyone to have more time for other tasks, reduced stress and improved team engagement.

Expensing on the go

As Finance Shared Services Center Innovation Senior Manager, I know that using the right tools and providing employees with the best solutions leads to motivation, higher productivity, and talent retention. If there’s something that makes finance teams happy is a smooth expense management flow.

Technology can be a powerful ally in breaking down barriers for everyone involved in the expense management process. Using the right tools can speed up processes that, before, could take weeks or even months to solve and turn into something that can be done in just a few minutes.

Adding to the above, it also solves another problem common in companies: the loss of receipts. With instant expense management and by using technologies such as Optical Character Recognition (OCR) — the same Rydoo uses on its expense management app —, employees can scan their receipts and the software converts written text into digital format, filling out the expense report in a couple of seconds. The app also keeps a digital copy of that same receipt.

Real-time expense management and the end of monthly peaks

As part of the finance team, with my background in accounting, one of the things I dreaded the most was reaching that final week before the end of the month. I’m sure we’ve all been through this. Trying to go through expenses as they come along to have everything up to date, but still having to deal with a big pile of reports to go through and spending countless hours looking at an Excel file.

For most companies, working with expense reports rather than going for the instant expensing approach leads them to deal with hundreds of reports to review, approve and reimburse by the end of the month. This process is what finance teams call “end-of-month peaks” because they would have to spend countless hours following paper trails, matching receipts to expenses, and attaching those to expense reports. Real-time expense management allowed us to change all that!

As an example, we’re able to immediately submit the expense of a ride by using Rydoo or the integration with the service provider app automatically creates that expense, get it approved and reimbursed, thus no one at the company needs to worry about it again. It creates a smoother flow for everyone involved, from the employee to the approver, finance teams and, in the end, for the CFO as well.

At the end of the day, going from a manual expense report management process to a fully digitised and instantaneous creates less stress for the whole team, leading to a better overall work experience.

A smoother expense management does not depend only on eliminating paper trails and expense reports but also from the fact that using the right software allows approvers to have more flexibility in their approval and rejection flows. By using Rydoo’s software I’m able to group all the expenses I need to manage. I can group them by trip, in case a group of employees needs to travel, by project or even by employee. After grouping these expenses, I’m also able to reject one expense at a time, instead of having to send a whole expense report back to the employee again.

At the end of the day, going from a manual expense report management process to a fully digitised and instantaneous creates less stress for the whole team, leading to a better overall work experience. It also helps organisations in what concerns policy compliance and to avoid fraud.

More visibility, less costs

Working in the finance department of an organisation where all employees comply with the company’s expense management policy might seems a utopian thought. Using technology that provides a solution to streamline these processes can help this utopian thought become more real by helping employees to stay compliant and allowing finance departments to stay in control.

With real-time expensing services, such as the one Rydoo provides, you’re able to simplify the process by creating automated approval flows for expenses based on your company’s internal policy. This allows for submitting and approving expenses almost immediately, and it also provides you with a valuable way to automatically reject expenses that are not compliant with your company’s policy. Whenever an out-of-policy expense is submitted the employee gets a policy warning which explains why the expense isn’t compliant and what changes can or need to be done before submitting.

Real-time expense management also allows you to have better visibility of overall expenses in real-time — even the unsubmitted ones — so you can make decisions faster, easily predict and control cash flows and avoid unexpected end-of-month surprises that can lead to stress. By creating automated approval flows, you’re also protecting your company from errors, duplicated expenses and fraud.

This will also help your organisation to save costs. Companies using expense reports would often ask their employees to submit a single report a month — or, sometimes, one every other month —, just to save on costs. This not only led to the feared end-of-month peaks, but also to added stress for the team. Moving to instant expense management and to subscription-based models allows you to stop focusing on the number of receipts submitted, because there’s no limit. It’s a faster, cheaper, and smoother solution for everyone.

Going for a real-time expense solution helps you to achieve better workflows for everyone in our organisation: employees can submit their expenses on the go and stop carrying receipts; the approver is able to streamline his workflow and have better visibility over what each employee is spending; the finance team has better control and ensures that everyone is in compliance with policies and regulations, without having to deal with stressful peaks at the end of the month.