The COVID issue had a wide-ranging impact, but who would have predicted that in January 2020, we’d have four separate VAT rates for the first time since 1979?

And yet that is the remarkable situation that the UK finds itself in as a result of The Treasury’s attempt to stimulate growth following the pandemic. As it stands employers who are processing expense claims will have to look out for four different VAT rates plus of course exempt, ‘outside the scope’ and ‘not registered’ costs so how can they ensure UK compliance?

In this piece. We’ll look at the different rates and show you how a good expenses system can reduce stress for all concerned.

More rates, more movement.

For people who have spent their working lives in finance the prospect of a VAT rate change is an unusual one.

Generally speaking the conversation about VAT has revolved around the application of the charge and not whether the actual rate will change. And whilst there have been movements between bands or changes to treatment of specific expenses, especially following tribunal results, the main rates haven’t changed since the coalition government put VAT up to 20% from 17.5% in 2011.

What we have seen in response to coronavirus are changes to VAT rates for specific industries and with the government needing to balance the competing challenges of stimulating the economy and paying off the national debt, we can expect more movement in the future.

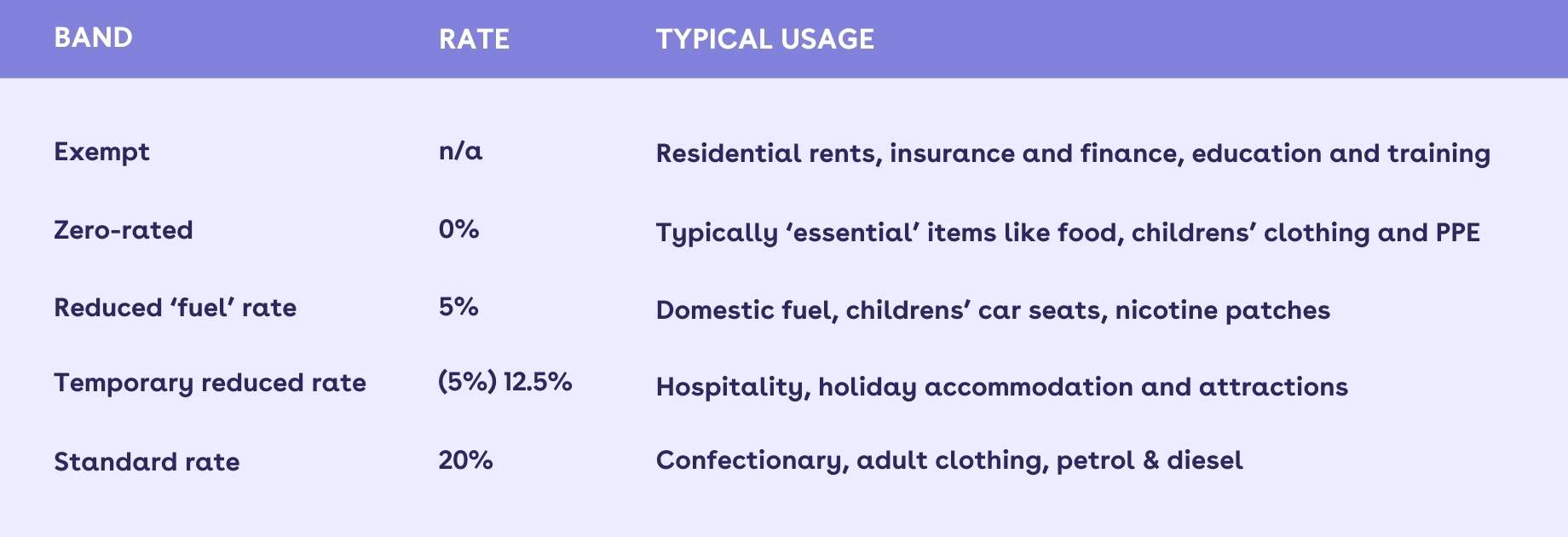

As it stands following the March 2021 budget we have the following VAT rates:

Hospitality reduced VAT rates

There’s no doubt that over the period of the pandemic, hospitality and tourist attractions have had a tough time.

Being locked down from March 2020 meant that they missed out on a large part of the spring tourist season and as a result, the government decided to introduce a reduced rate to help the sector when things started to open up again in June.

The ‘temporary reduced rate’ was introduced on 15th July 2020 in a bid to provide a stimulus and was set at 5% and expected to last until the end of the year however, in September the Chancellor extended this until March 2021. In the March 2021 budget, a further extension was announced that took the 5% rate to the end of September 2021 and then applied a 12.5% rate from then until March 2022 with the sector reverting to the standard rate of 20% from April 1st, 2022.

What we can see is that the government has been responsive to the needs of the tourist and hospitality industry and rather than giving grants or loans, has preferred to use VAT changes as a way of stimulating growth. The problem for companies processing expense returns is that changes in rates and extending dates make life incredibly difficult.

It is also possible that The Treasury may take the view that VAT is the way to go when trying to kick-start the economy and we could see other changes to rates and the sectors to which they apply in the future. What seems to be beyond doubt is that the government will need to find a way to pay down the national debt at some point and this may well be through overt VAT rises or stealthily changing the VAT bands that goods or services fall into.

The key message is that when we are looking at VAT in the UK we need to remain flexible and have a way of responding to changes quickly.

Use the flexibility of systems to take the strain

There are two key points to managing expenses when VAT is constantly changing; keeping up with the news and staying flexible.

Finance staff needs to make sure that they are keeping abreast of any potential changes in rates and treatment and the best way to do this is to check the government’s own VAT website pages and services like accountingweb for information. Being forewarned of changes is half the battle after all.

Finance staff should then look at their expense management tool to take the strain of changes in rates. Admittedly, if you are using paper or spreadsheet-based systems then this is going to be difficult as you’ll have to change templates or individual worksheets. If you use a modern expense management tool like Rydoo then you will have an advantage as it is a simple matter to add new rates and make them available for all users.

If the standard rate changes then you can alter the percentage value in seconds or alternatively create a completely new rate so that people can make claims that include VAT paid both before and after the change. And when the temporary rate increases later in the year, there is just one change to make to alter the whole system. Similarly, as the 12.5% rate comes to an end in 2022 it will take seconds to withdraw it from use for all staff.

If the government decides to make changes to the bands that specific expenses fall into it is an easy job to simply alter the VAT rate that applies centrally so that users do not have to think about how to code the expense.

VAT management doesn’t have to be hard

Although there have been plenty of changes to the VAT rules in the UK recently that doesn’t mean to say that the government is finished.

It is likely that they will need to claw back some of the furlough and grant payments that have been made and one way to do that is by changing VAT rates and their application. It would certainly be surprising if we’d seen the last of VAT changes for this parliament, especially as we have seen a government use the tax as a way of social engineering.

But just because changes are likely, doesn’t mean to say that life has to be difficult for finance staff. Using an excellent system like Rydoo will mean that responding to changing VAT rules and ensuring UK compliance is actually pretty straightforward and shouldn’t be time-consuming.