A business meeting on the outskirts of town, picking up supplies, or driving to the bank for a transaction. These are common tasks that require employees to use their personal vehicles for work. And they’re doing it more than ever.

The rise of remote and hybrid work has increased the number of employees using personal vehicles for business purposes. To fairly compensate them, many companies offer mileage reimbursement — but what exactly does that mean, and why is it important for your finance team to manage it properly?

Key takeaways

- Mileage reimbursement is not always mandatory, but it offers major benefits, including tax advantages, reduced payroll costs, and improved employee satisfaction and retention.

- Not all trips qualify for reimbursement. Only work-related travel outside of commuting is eligible, and documentation is essential for compliance and audit readiness.

- Standard mileage rates simplify the process. Most governments update their rates annually, allowing businesses to reimburse employees without tracking every cost individually.

- Automating mileage reimbursement saves time and ensures compliance. Tools like Rydoo calculate rates, track distance via Google Maps, and allow for better budget control.

What is mileage reimbursement?

Mileage reimbursement means compensating employees for using their personal vehicles for work-related trips. If a company doesn’t provide a fleet of vehicles, employees often use their own cars to reach their destinations.

These trips incur a variety of costs, including fuel, tolls, wear and tear, insurance, and depreciation. Tracking, calculating and reimbursing all of these would create a heavy administrative burden for employees and finance teams. That’s why many governments offer a standard mileage rate.

Tax offices and official bodies such as the HMRC in the UK or the IRS in the USA typically determine an annual flat rate based on average vehicle-related expenses, creating a simple, compliant, and scalable solution for businesses. These rates differ by jurisdiction and are reviewed annually.

Instead of asking employees to submit each receipt, companies can simply multiply the number of business miles by the standard rate. It all comes down to math. For example, if a country sets the mileage rate at €0.55/km and an employee drives 500 km in a month, they’ll be reimbursed €275.

Do you really need to pay mileage reimbursement?

In most countries, employers aren’t legally required to reimburse mileage, but there are exceptions. In the US, for example, companies must reimburse if failing to do so would bring an employee’s wage below the minimum wage. Some states, like California and Massachusetts, have additional rules.

Rather than detailing every local exception, we recommend checking Rydoo’s Compliance Centre for the most up-to-date information.

It’s also important to keep in mind that, even when not required, reimbursing mileage comes with major benefits. These reimbursements are often tax-deductible, improve employee satisfaction, and reduce turnover.

How does mileage reimbursement work?

Mileage reimbursements might seem pretty straightforward, but it’s important to note that not all car journeys qualify. Commuting to and from the office, for instance, doesn’t count. Reimbursements apply only when employees drive to perform specific business tasks, such as visiting clients, attending off-site meetings, or picking up supplies.

These reimbursements account for the total cost of driving one kilometre (or mile) in a private vehicle, with rates varying by jurisdiction. Employees can receive this reimbursement tax-free, as it represents an estimate of a business expense.

These amounts are not binding, so companies can choose different rates for reimbursing employees’ mileage expenses. However, if they opt for a rate above the one established by the government, the additional amount counts as part of the employee’s salary, making it taxable. You can find the mileage reimbursement rates set by local governments in Rydoo’s Compliance Centre.

The final step in the mileage reimbursement process is, simply put, to do the math. Businesses must keep detailed records to ensure compliance. This can be done using a spreadsheet or a digital system that simplifies the process, such as Rydoo.

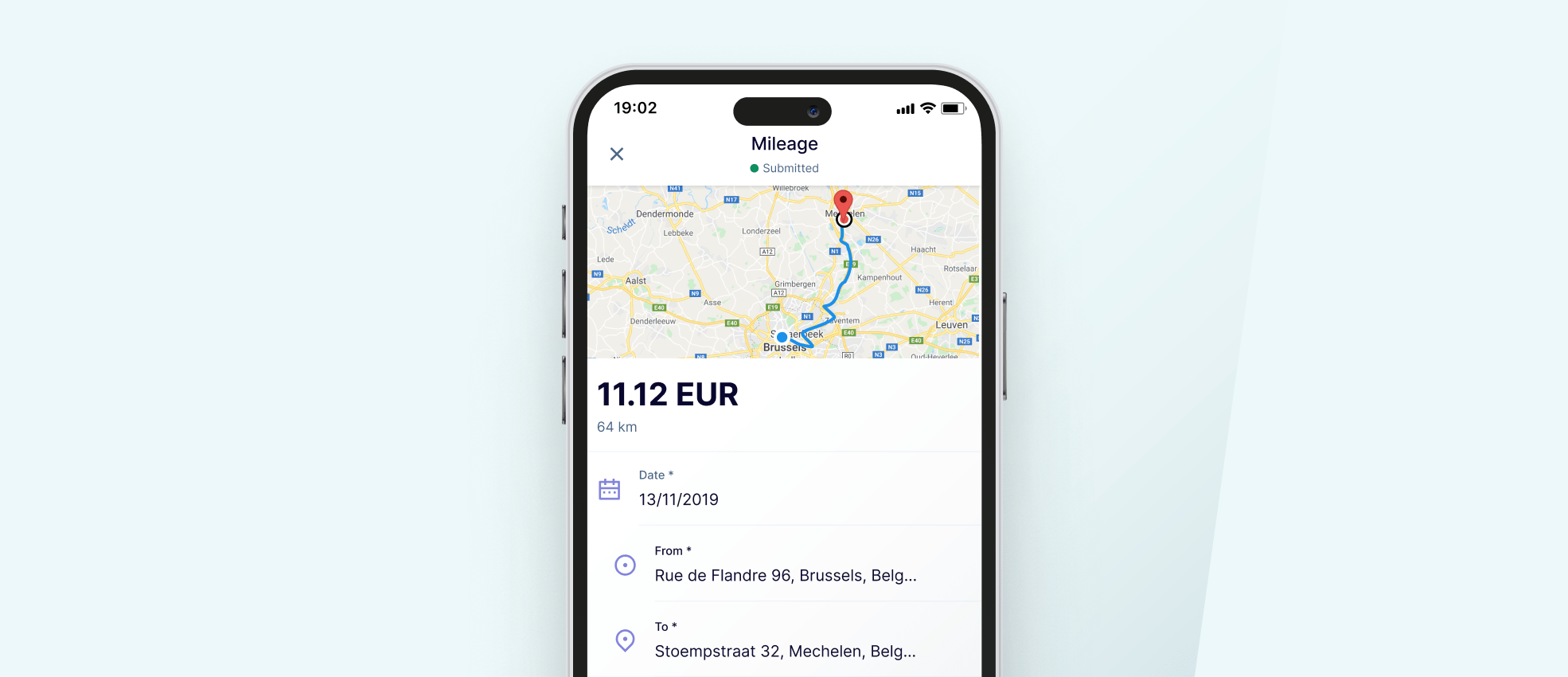

Rydoo’s mileage tracking allows employees to enter start and end points in the app, and Google Maps does the rest. Finance teams and managers receive complete trip information — date, distance, purpose — with every reimbursement request, which is kept on their records, saving time and reducing errors.

Why should you reimburse mileage?

Aside from reducing friction for employees and allowing finance teams to stay compliant, reimbursing mileage has multiple benefits for businesses, including:

Reduced payroll tax

Bumping up an employee’s salary to cover travel expenses increases tax liability. Mileage reimbursements avoid that.

Simpler bookkeeping

Managing a company fleet means tracking maintenance, insurance, depreciation, etc. Mileage reimbursements require far less overhead. With mileage reimbursements, all they need to track is the route and reason for the trip, so they know how much to reimburse.

Conserved capital

Purchasing or leasing company vehicles can be costly. Mileage reimbursement lets businesses avoid that investment.

Lower expenses

With mileage reimbursements, employees bear all the cost of their vehicle choices, including gas, maintenance and insurance.

Happier employees

Reimbursing fairly encourages staff to go the extra mile — literally. It builds trust and increases retention.

How to manage mileage reimbursements

Mileage reimbursements can bring great benefits for companies but can also lead to roadblocks if teams try to handle it manually.

With Rydoo, mileage reimbursements become a fast, automated, and compliant process for everyone involved.

Employees enter the trip’s starting and ending points through the Google Maps integration. The system then calculates the distance and applies the correct rate, according to the jurisdiction and company policy.

Managers can easily review and approve mileage claims in real-time through the app. As for Finance teams? They get full and immediate visibility over all company trips for faster reporting and better spending control.

Mileage reimbursement is a strategic benefit for both companies and employees. It offers financial relief to workers who use their vehicles for business, increases satisfaction and retention, and helps organisations stay compliant while keeping costs under control.

As the number of employees using personal vehicles for work continues to rise, especially with hybrid and remote work models, making the reimbursement process as simple as possible is more important than ever. Platforms like Rydoo make it easy: from calculating jurisdiction-specific rates to maintaining digital records for compliance, every step is automated.

By turning to smart expense management tools, companies save time, reduce admin burden, and create a seamless experience for their finance teams and employees.

If you’re looking for a way to simplify your mileage tracking and reimbursement process, book a demo with Rydoo’s team.