CFO Corner / Categories:  Compliance

Compliance Strategy

Strategy

2025-12-09 | 5 min read

The hidden 14%: what your expense data isn’t telling you

Most finance leaders share the quiet belief that their expense process is a smooth operation that only handles policy-compliant claims. It might look like it on the surface, but every business has its blind spots. They just haven’t been uncovered.

According to Rydoo’s latest research, which analysed over 10 million processed expenses in Rydoo’s Smart Audit data set, while 86% of business expenses are compliant, the remaining 14% tell a different story. They hide policy violations that quietly drain budgets, distort forecasts, and weaken financial confidence. And because manual reviews often miss them, the real exposure remains invisible.

The good news is that seeing the full picture doesn’t require a massive process overhaul. With clearer insights and smarter tools, finance leaders can finally understand what’s truly happening in their expense data and build new processes that prevent issues from happening.

The 14% problem: why most finance teams don’t see their real exposure

From the outside, expense management looks simple: claims are submitted, reviewers approve them, and policies keep everything in check. However, this flow creates a limited field of vision. Finance teams only see what passes through their hands, but not the patterns across thousands of claims.

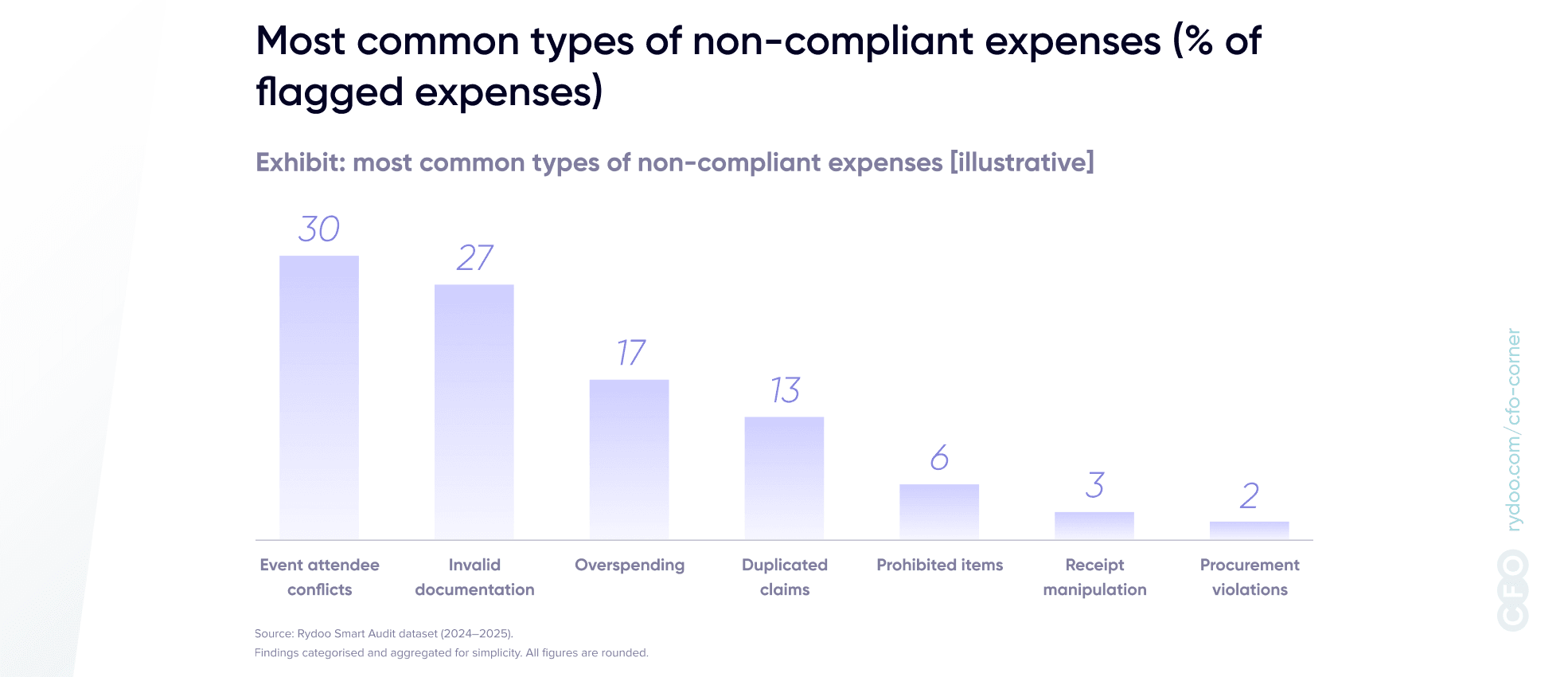

The Smart Audit data set shows what happens when businesses follow this process, including what the blind spots — the 14% of non-compliant expenses — can hide. Out-of-policy claims fall into two categories:

- 9% are non-intentional violations: small errors, policy misunderstandings, missing details, or accidental duplicates;

- 5% are intentional violations: deliberate attempts to stretch policy, reuse receipts, or disguise personal expenses as business-related.

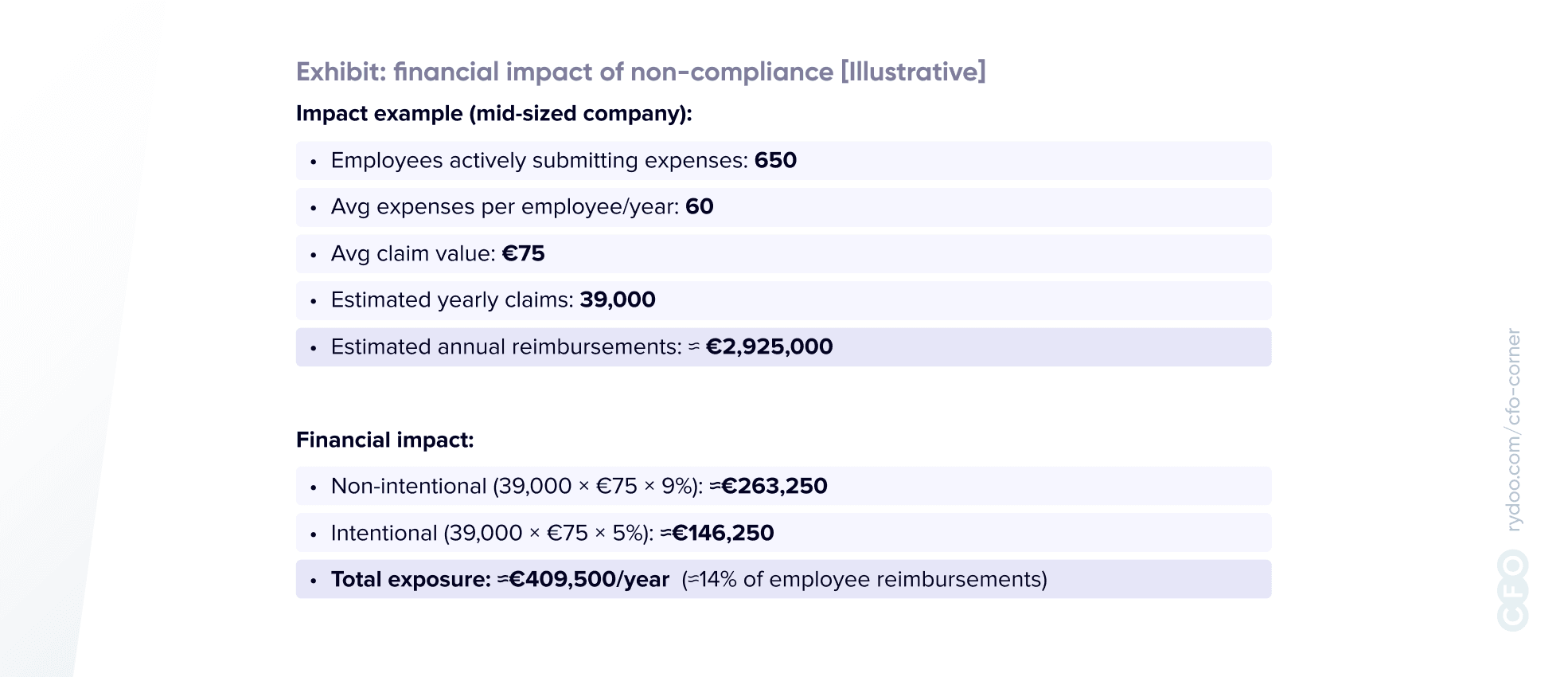

These might look like small and harmless numbers. But for a mid-sized company processing around 39,000 claims a year at an average of €75 per claim, that represents over €400,000 in exposure each year. If these issues consistently go unnoticed, they can cost businesses far more than they expect.

Aside from the risk of losing funds, these blind spots create a false sense of control. When finance leaders assume their data is clean, every financial decision, from forecasting to budgeting, is made based on inaccurate information.

Why manual reviews create blind spots, not control

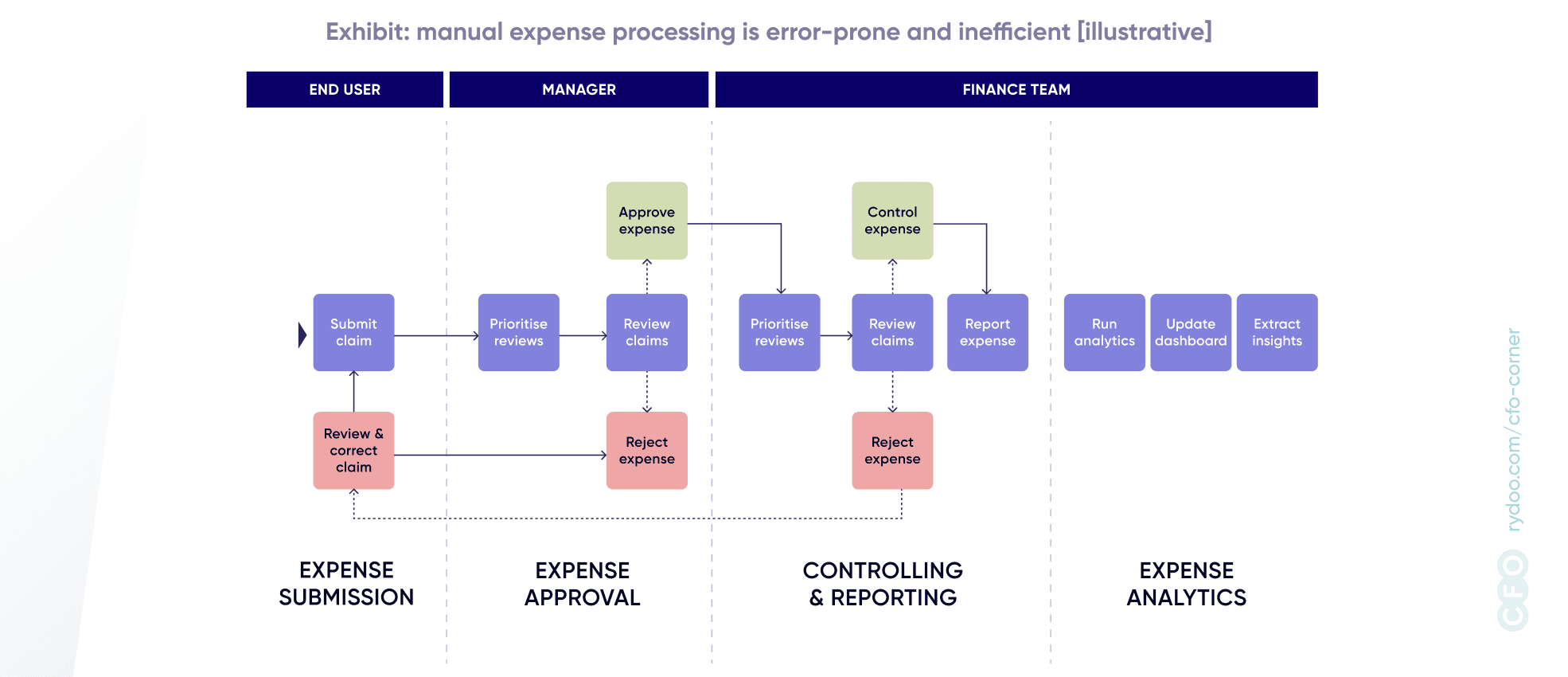

Manual reviews feel thorough, giving finance teams a sense of ownership and control. But the data tells a different story.

Human reviewers naturally focus on what’s in front of them, not on patterns, trends and systemic issues. More often than not, they are checking compliant, low-risk claims. Meanwhile, high-risk anomalies stay buried in volume.

Using the same mid-sized company example, manual processing can take nearly 2,000 hours per year. That is roughly the workload of one full-time employee spent on low-value checks. Even skilled reviewers cannot compare thousands of historic claims or recognise clever ways to misuse the system.

At a time when business expenses are growing in volume and complexity, Smart Audit data shows that manual auditing creates uneven control: too much time correcting harmless claims and not enough time identifying meaningful risk. As a result, errors slip through, duplicates get reimbursed, and AI-generated or manipulated receipts go unnoticed.

Clearly, the human element isn’t the flaw, but the massive, data-driven task we are asking them to do manually. This is where AI can redefine the expense process.

How AI changes the equation: visibility, accuracy, and real-time detection

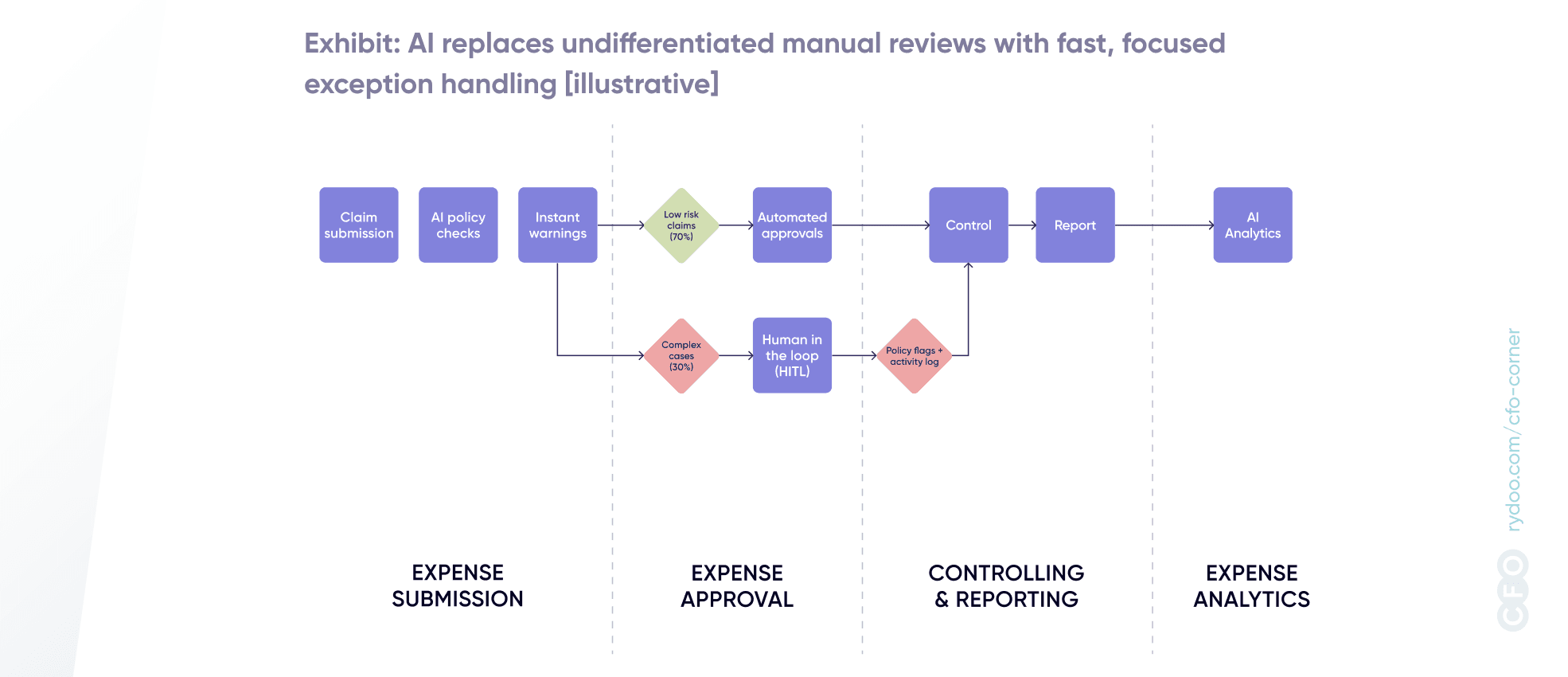

In recent years, AI has been changing finance processes, and expense management is no exception. It gives finance teams capabilities that manual processes simply cannot match. Instead of sampling or spot-checking, AI analyses all business claims in real time, detects anomalies instantly and learns from past behaviours.

With the right technology in place, it’s possible to uncover what lies behind the 14% of non-compliant claims that the human eye often misses, including duplicates across dates or merchants, suspicious receipt structures, file metadata inconsistencies, or repeated patterns of misuse.

The results speak for themselves. Rydoo Smart Audit, for instance, identifies anomalies with around 97% accuracy and can automatically process around 70% of low-risk, compliant claims. For finance teams, this means more control and oversight, with less manual work.

This doesn’t mean AI is here to replace finance teams. It will take over the repetitive work, so humans can focus on what they’re best at: judgment, policy refinement, communication, and strategic risk management.

Visibility is power: how clearer data leads to better decisions

With regulations that keep changing and market uncertainty, full financial visibility of businesses’ spending patterns has become one of the strongest forms of financial control.

Having real-time expense visibility helps finance leaders understand where mistakes happen, identify which policies are unclear or misunderstood and intervene before they become systemic issues. It also allows for faster decision-making and contributes to a stronger compliance culture by making the review process easier and faster, and ensuring consistency across every claim.

When those 14% of hidden issues become visible, everything improves, from forecasting accuracy and budget planning to employee behaviour and organisational trust. It also gives finance leaders the information they need to make better long-term decisions.

The future is prevention, not detection

For years, expense auditing was all about reacting — identifying mistakes and correcting them. Now, AI allows finance teams to shift into a preventative mode, where the system corrects the issues before they become problems.

Real-time checks guide employees at the moment of submission, reducing errors, reinforcing expense policies, shaping behaviours and building a culture of compliance. Over time, this moves organisations towards “no-touch” expense processing, where most low-risk claims are handled automatically, while keeping humans in the loop to review potentially risky or ambiguous claims.

Seb Vanhecke

CPO @ Rydoo

“We’re moving from AI that follows rules to AI that helps refine them. The future of expense governance is intelligent, adaptive, and continuous.”

With 14% of expenses distorting the truth, clarity has become a strategic advantage, and AI is how finance leaders take it back.