Travelling for work is crucial in some industries, but so is controlling travel costs. Just ask any finance team member who works with a team that’s constantly on the move. Per diem allowances provide a structured and efficient way to handle business travel expenses and ensure compliance with tax regulations.

However, there’s more to it than it might seem. Understanding how per diem works across different jurisdictions is a must to avoid compliance risks and optimise cost control. This article will provide an in-depth look at the definition of per diem rates, their benefits, tax implications, and the best way to make it easier for the whole organisation.

What is per diem?

Per diem (Latin for “per day”) refers to a fixed daily allowance that employers provide employees to cover travel-related expenses, such as meals, lodging, and incidentals, instead of reimbursing actual costs. It simplifies expense management, improves budget predictability, and ensures compliance with local regulations.

That is to say that if a team member travels for a client meeting outside their usual place of work, the company can pay a daily allowance, which should cover all necessary expenses for the journey without needing reimbursements. However, there are some exceptions, which we’ll cover below.

Understanding how per diem works across different jurisdictions is a must to avoid compliance risks and optimise cost control.

The amount of per diem an employee receives often varies according to the destination, as the cost of living in each region can also be different. Different countries have specific per diem regulations, including the maximum amount allowed, which are often set by tax authorities or government agencies. In the U.S., the IRS establishes per diem rates (IRS, 2025) and in Europe each country follows its own rules, such as Germany’s Bundesreisekostengesetz (BRKG) and the UK’s HMRC-approved per diem rates (HMRC, 2025).

Companies can choose to abide by these rates or set their own. However, in most cases, if they grant higher daily allowances than the government-set rates, the surplus will be counted as the employee’s taxable income.

Why companies use per diem allowances

Employees need to spend whenever they travel for work, wether it’s a cup of coffee before an early flight or transport to and from the airport. Without per diem allowances, this would naturally result in a pile of expenses to review, approve and reimburse.

By using per diem allowances, companies — and especially finance teams — are able to:

- Simplify expense reporting → Employees don’t need to collect and submit receipts for every meal or incidental expense, reducing the administrative workload.

- Ensure tax compliance → Per diem reimbursements are tax-free if the organisation stays within the government-set limits.

- Prevent overspending → With standardised rates, businesses can control travel costs by avoiding excessive claims.

- Reduce reimbursement errors → Setting rates eliminates the risk of miscalculations and policy violations tied to individual expense claims.

Per diem exceptions

While per diem allowances are widely used, there are specific cases where they may not apply or require adjustments. These are some of the exceptions companies should be aware of to ensure compliance:

Extended business trips

Some jurisdictions, such as Germany and France, limit the number of consecutive days per diem that can be claimed. Longer stays may lead to deductions or even require expense reimbursements.

Hybrid work & remote assignments

Employees working remotely from different regions may not qualify for per diem, as their travel may not be considered temporary business travel.

Industry-specific limitations

Certain industries, such as government contracts or NGO operations, may have additional per diem restrictions or require direct cost reporting instead of lump sum allowances.

Country-specific restrictions

Some tax authorities require additional documentation or impose different tax treatments depending on the nature of the business travel.

Understanding these exceptions allows companies to set clearer policies, ensuring employees receive the right allowances without violating compliance rules.

Common per diem challenges & how to overcome them

While per diem management can bring many benefits, it also comes with its fair share of compliance risks and operational challenges. One of the most common is the global inconsistencies arising from varying tax laws in different regions, making it difficult to standardise per diem policies.

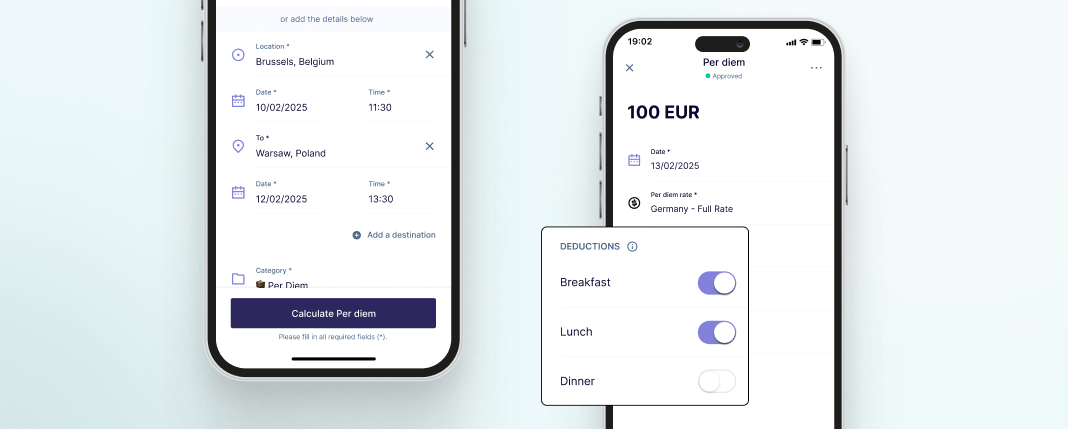

To tackle this, companies can benefit from implementing a centralised system that tailors per diem rates to specific regions, ensuring smooth global expense management. Rydoo’s smart expense management software offers a real-time database of per diem rates across multiple jurisdictions, making it easier for businesses to automatically apply the right allowances based on their location and local regulations.

Another issue is employee misuse, where some employees may claim per diem on non-business-related travel. AI-powered compliance tools can help by flagging irregular per diem claims, reducing the risk of fraudulent submissions. Rydoo’s built-in policy controls allow finance teams to set automatic alerts and flag non-compliant claims before submission, ensuring compliance with company policies.

Additionally, Rydoo Smart Audit automatically detects when an expense that conflicts with an approved per diem claim is submitted, flagging potential duplicates or errors before processing. This ensures that businesses maintain full compliance while preventing unnecessary reimbursements.

Frequent changes in tax laws also create uncertainty in per diem administration. To mitigate this, finance teams should work with tax consultants and leverage automated compliance tracking to stay up to date with legislative changes. Rydoo integrates real-time tax updates and policy tracking, allowing finance teams to adjust per diem policies proactively and ensuring compliance with the latest regulations while optimising expense policies.

Best practices for per diem compliance

We’ve covered how per diem can be a simple and efficient way to control business expenses, but finance can only grasp its real benefits if all the best practices are followed.

By following this set of guidelines, organisations can ensure tax efficiency and avoid audits.

Use government-approved rates

Always align company per diem policies with official rates to maintain compliance.

Leverage automation

AI-powered expense management tools, like Rydoo, automatically apply the correct per diem rates based on travel location and duration.

Communicate clear policies

Educate employees on per diem limits, tax rules, and reporting expectations to reduce policy violations.

Review rates annually

Update your per diem policy each year to align with regulatory changes and avoid non-compliance.

Per diem is essential for managing corporate travel expenses, ensuring tax compliance, and improving administrative efficiency. However, managing it doesn’t have to be a challenge. With the right policies in place and by using the right tools, businesses can simplify travel expense management, reduce compliance risks, and improve financial oversight. Automating per diem management doesn’t just make reporting easier. It allows finance teams to focus on strategic initiatives rather than administrative tasks.

Businesses must refine their policies and rely on the latest technology by implementing solutions like Rydoo’s to stay compliant while optimising expense management. With an automated system in place, finance teams can reduce manual work, eliminate errors, and gain full visibility into employee travel expenses.

The result? A more efficient, compliant, and future-proof approach to managing business travel costs.