Arjo is a global company that helps professionals across care environments to raise the standard of safe and dignified care. With over 5900 employees worldwide and customers in over 60 countries, the company is seeing exponential growth – In 2016 their sales amounted to about SEK 8 billion. Also, during the pandemic they supplied beds and lifting equipment to the Britsh National Healthcare Service (NHS).

Challenge

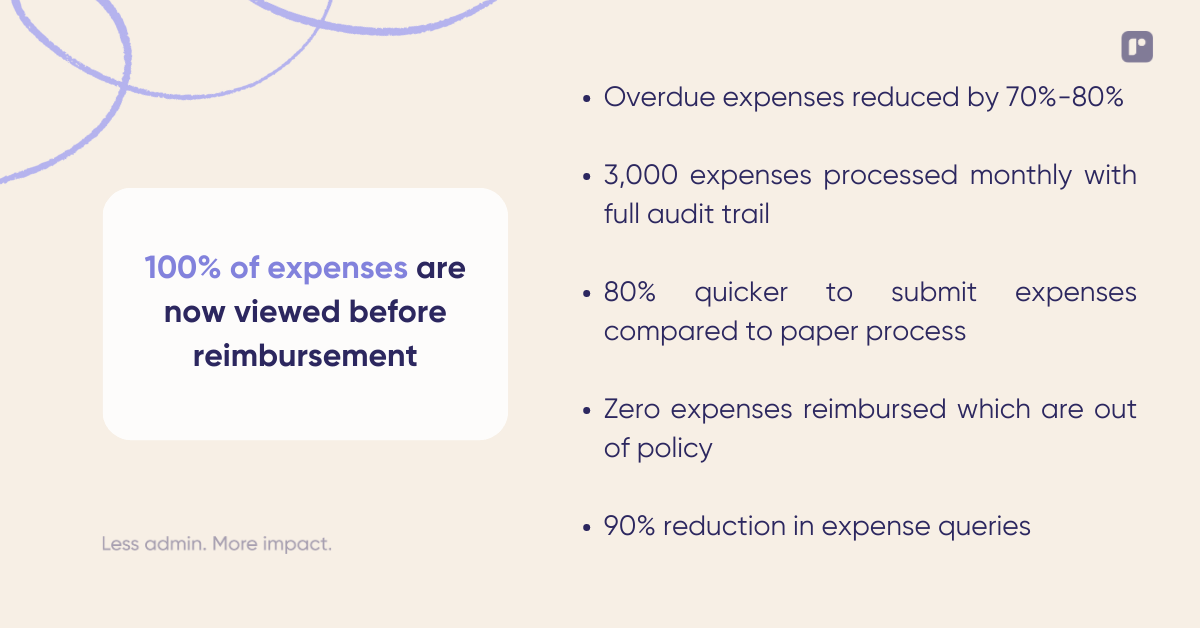

Around 400 Arjo employees regularly submit their expenses to the finance department in the UK alone, which amounts to around 3,000 expenses monthly. Chris Walker, Expense Manager, explains the process before they started using Rydoo: “We had a paper process where employees attached their receipts to a paper form and sent it to my team to process. Then we’d reimburse cash expenses or match off credit card expenses.”

With so many people submitting their expenses to the team, the paper process was lengthy and tedious. Chris explains that they encountered all sorts of problems including missing and mismatched receipts as well as receipts getting lost in transit to the finance team. All resulting in money coming out of Arjo’s account and no track of what it was spent on.

Chris adds, “When I joined the business the finance director said that they wanted to implement a new expense management tool. The current paper process was tedious and time consuming for both employees and the finance team.”

For those expenses that are still out of policy, it is easier to enforce as we can check the history and the audit trail of each expense.

Chris Walker

Expense Manager

Solution

A few months after starting his new role at Arjo, Chris dove right into how the expense process could be improved. He knew there were tools that could help as he had used expense management tool Concur in the past. Although, he wasn’t completely sold on Concur: “With Concur you can create a virtual expense report, like you would on paper. Every time you’ve had an expense, you can add it to the report. I felt there were more clicks and more steps to submit an expense compared to Rydoo.”

Eager to find an expense management tool that really delivered, Chris, the finance director and the financial controller started a tender process.

Chris was aware that switching to digital would be a big change. He says: “A lot of our employees have been with the company a very long time. They were very set in their ways when it came to expenses. They would set a specific day each month to complete their expenses and build up to that day”.

“Rydoo is intuitive. You could submit an expense without any training if you really thought about it. I don’t think you can do that on other expense platforms.”

To make the switch painless, his top priority was for the new tool to be really easy to use and intuitive: “We needed to be able to say to our employees, ‘this is our brand new expense management tool, it’s easy to use and it’s user friendly’. We wanted the platform to look inviting so you can navigate around with minimal training. You can pick it up just by looking and navigating around the platform and speaking to a colleague and they can easily guide you through it. There’s no intense training necessary.”

Implementation

Chris happily took on the project manager role. He explains: “My job was to work with the accountants to obtain all the general ledger coding and description of categories for Rydoo. It was also my role to speak with HR to obtain the user information. So I was liaising with different parts of the business to get the correct information.”

He also worked with Giljan, Rydoo’s Customer Success Manager to upload all the data into the platform. Chris describes working with Giljan as “brilliant” before expanding: “I’d send him an email and within a day, he’d reply back. He was excellent at replying and resolving the issues I was facing. This is the customer service you expect when you purchase a new product or service. I have seen other projects where once you bought a product or a service, they are quick to take your money and run. They don’t provide great customer service or the information you need. It’s completely different with Rydoo.”

“The customer service has always been there for me from day one, which is really good. We expected a good service, but not as good this. With Rydoo, you feel that you’re actually engaging with someone who cares about you as a business and as a person, to help you resolve the issue.”

Results

Saving time has been one of the main benefits of using Rydoo. Chris explains that he and his team can now see every single expense in Rydoo and question it easily if needed. This wasn’t the case with the previous paper process. He says: “In Rydoo, you press reject, enter your comment and it goes back to the employee so they can amend and resubmit.”

“It saves employees a lot of time as they’ve got use of the Rydoo mobile app too. Many of our employees are field-based so they are not in an office. Therefore, the app helps them upload their receipts on the go. You can also email a receipt to Rydoo, which is quite impressive as it saves you printing it. Rydoo then puts it straight in your profile ready to submit. Employees are happy they can use the mobile app and the email feature as it allows them to get back to the day-to-day tasks in their roles more quickly. Employees also submit their expenses in a more timely manner thanks to Rydoo.

“Employees are happy they can use the mobile app and the email feature as it allows them to get back to the day-to-day tasks in their roles more quickly. Employees also submit their expenses in a more timely manner thanks to Rydoo.”

Another major win for the finance department is to clearly see where the money is spent: “The reporting from Rydoo allows us to understand spend in more detail – the categories are customizable to our needs and we can provide accurate reporting”.

“It’s obviously helped our cash flow as well, because we’re reimbursing cash expenses that are current.”

Chris explains that his team often received outdated expenses in the past: “Before, we were getting cash expenses that were maybe six months old. We have an expense policy where any cash expense over three months shouldn’t be reimbursed. We are now finding employees are submitting expenses well within policy. For those that are still out of policy, it is easier to enforce as we can check the history and the audit trail of each expense.”

There were a few extra surprises along the way. Some employees told Chris they actually enjoy doing their expenses now!

“People actually came to me and said, ‘Rydoo is one of the best things we’ve implemented in this business for expenses”.

“We didn’t expect such great feedback within such a short space of time after implementation because you’re always unsure when you roll out a new tool if people are going to adopt it and take to it, but a lot of employees have.”

Tired of dealing with out of policy expenses? Contact one of our experts and let us help!